On January 3, 2020, Mego Limited purchased 3,000 (30%) of the common shares of Sonja Corp. for

Question:

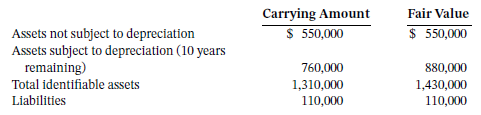

On January 3, 2020, Mego Limited purchased 3,000 (30%) of the common shares of Sonja Corp. for $438,000. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition:

During 2020, Sonja reported the following information on its statement of comprehensive income:

Income before discontinued operations ...................................................................... $200,000Discontinued operations (net of tax) ............................................................................... (50,000)Net income and comprehensive income ....................................................................... 150,000Dividends declared and paid by Sonja on November 15, 2020 .................................. 110,000

Assume that the 30% interest is enough to make Sonja an associate of Mego, and that Mego is required to apply IFRS for its financial reporting. The fair value of Sonja?s shares at December 31, 2020, is $147 per share.

Instructions

a. Prepare the journal entry to record Mego?s purchase of the Sonja shares on January 3, 2020. Any unexplained payment represents unrecognized goodwill of Sonja.

b. Prepare all necessary journal entries associated with Mego?s investment in Sonja for 2020. Depreciable assets are depreciated on a straight-line basis.

c. Would any of your entries in part (b) change if you were told that Mego?s long-term business prospects had deteriorated and that the most Mego could expect to recover in the future or to sell its investment in Sonja for at December 31, 2020, is $115 per share? If so, prepare the entry and explain briefly.

d. Ethics A member of senior management has approached you, a CPA, informing you that, instead of the shares being worth $115 per share as in part (c), the shares are worth $150 each. Senior management receives a bonus based on net income. He mentions that the assumptions about long-term business prospects are too pessimistic and are not reflective of the economic reality at Sonja. You feel pressure to appease management, given that your boss is a member of senior management. What should you do?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy