On two previous occasions, the management of Dennison and Company, Inc., repurchased some of its common shares.

Question:

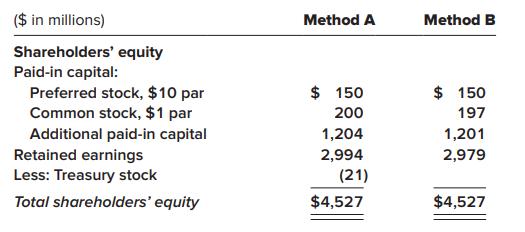

On two previous occasions, the management of Dennison and Company, Inc., repurchased some of its common shares. Between buyback transactions, the corporation issued common shares under its management incentive plan. Shown below is shareholders’ equity following these share transactions, as reported by two different methods of accounting for reacquired shares.

Required:

1. Infer from the presentation which method of accounting for reacquired shares is represented by each of the two columns. 2. Explain why presentation formats are different and why some account balances are different for the two methods. 1. Infer from the presentation which method of accounting for reacquired shares is represented by each of the two columns.

2. Explain why presentation formats are different and why some account balances are different for the two methods.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 9781259722660

9th Edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas