Russell-James Corporation is a diversified consumer products company. During 2021, Russell-James discontinued its line of cosmetics, which

Question:

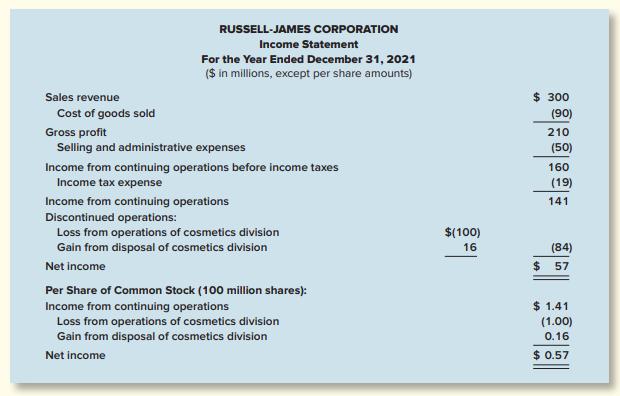

Russell-James Corporation is a diversified consumer products company. During 2021, Russell-James discontinued its line of cosmetics, which constituted discontinued operations for financial reporting purposes. As vice president of the food products division, you are interested in the effect of the discontinuance on the company’s profitability. One item of information you requested was an income statement. The income statement you received was labeled preliminary and unaudited:

You are somewhat surprised at the magnitude of the loss incurred by the cosmetics division prior to its disposal. Another item that draws your attention is the apparently low tax rate indicated by the statement ($19 ÷ 160 = 12%). Upon further investigation, you are told the company’s tax rate is 25%.

Required:

1. Recast the income statement to reflect intraperiod tax allocation.

2. How would you reconcile the income tax expense shown on the statement above with the amount your recast statement reports?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas