Sanderson Inc., a pharmaceutical distribution firm, is providing a BMW car for its chief executive officer as

Question:

Sanderson Inc., a pharmaceutical distribution firm, is providing a BMW car for its chief executive officer as part of a remuneration package. Sanderson has a calendar year end, issues financial statements annually, and follows ASPE. You have been assigned the task of calculating and reporting the financial statement effect of several options Sanderson is considering in obtaining the vehicle for its CEO.

Option 1: Obtain financing from Western Bank to finance an outright purchase of the BMW from BMW Canada, which regularly sells and leases luxury vehicles.

Option 2: Sign a lease with BMW Canada and exercise the option to renew the lease at the end of the initial term.

Option 3: Sign a lease with BMW Canada and exercise the option to purchase at the end of the lease. The amount of the option price is financed with a bank loan.

For the purpose of your comparison, you can assume a January 1, 2014 purchase and you can also exclude all amounts for any provincial sales taxes, GST, and HST on all the proposed transactions. You can also assume that Sanderson uses the straight-line method of depreciating automobiles. Assume that for options 1 and 2, the BMW is sold on January 1, 2019, for $10,000.

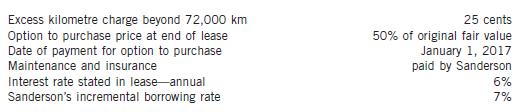

Sanderson does not expect to incur any extra kilometre charges because it is likely that the BMW won’t be driven that much by the CEO. However, there is a 10% chance that an extra 10,000 km will be driven and a 15% chance that an extra 20,000 km will be used.

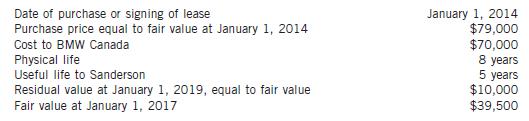

Terms and values concerning the asset that are common to all options are the following:

Borrowing terms with Western Bank for purchase: Option 1

For Option 2:

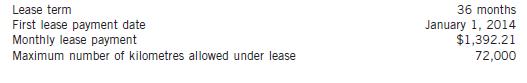

Terms, conditions, and other information related to the initial lease with BMW Canada:

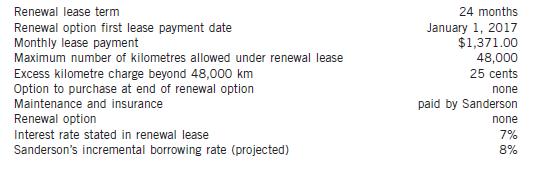

Terms, conditions, and other information related to the renewal option for lease with BMW Canada:

Borrowing terms with Western Bank to exercise option to purchase: Option 3

Instructions

(a) For Option 1:

1. Using a financial calculator or computer spreadsheet, calculate the quarterly blended payments that will be due to Western Bank on the instalment note.

2. Prepare an amortization schedule for the loan with Western Bank for the term of the lease.

3. Record all of the necessary transactions on January 1, 2014, the first loan payment, and for any adjusting journal entries at the end of the fiscal year 2014.

(b) For Option 2:

1. Using a financial calculator or computer spreadsheet, determine how BMW Canada arrived at the amounts of the monthly payment for the original lease and for the lease renewal option, allowing it to recover its investment.

2. Assume that the original lease is signed and Sanderson Inc. has no intention of exercising the lease renewal. Determine the classification of the three-year lease for Sanderson Inc.

3. Assume that Sanderson fully intends to exercise the renewal option offered by BMW Canada. Determine the classification of the lease for Sanderson Inc.

4. Prepare a lease amortization schedule for the term of the lease for Sanderson Inc.

5. Record all of the necessary transactions on January 1, 2014, for the first two lease payments and for any adjusting journal entries at the end of the fiscal year 2014 for Sanderson Inc.

(c) For Option 3:

1. Determine the classification of the lease for Sanderson Inc.

2. Record all of the necessary transactions concerning the lease on January 1, 2014, and for any adjusting journal entries at the end of the fiscal year ending December 31, 2014.

3. Using a financial calculator, or computer spreadsheet functions, calculate the quarterly blended payments that will be due to Western Bank on the instalment note used to finance the purchase.

4. Prepare an amortization schedule for the loan with Western Bank.

5. Record all of the necessary transactions concerning exercising the option to purchase on January 1, 2017, the signing of the instalment note payable to the bank, the first loan payment, and any adjusting journal entries at the end of the fiscal year ending December 31, 2017.

(d) Use the contract-based approach in the proposed standards and assume the information in Option 2. Update, if necessary, and reproduce the amortization table needed under this approach for the first 13 payments of the lease. Prepare the journal entries on January 1 and February 1, 2014, and for any adjusting journal entries at the end of the fiscal year ending December 31, 2014.

(e) Assume that the amount paid by Sanderson on July 1, 2017, equals the amount calculated based on probability weighting for the excess charge for kilometres driven. How would you account for the penalty Sanderson expects to pay?

(f ) Prepare a table of the financial statement results from the above three options and the contract based approach of part (d). Your table should clearly show all of the classifications and amounts for the statement of financial position at December 31, 2014, and the income statement for the 2014 fiscal year.

(g) Calculate the amount of the expense for the BMW for the total five-year period based on each of the three assumptions, as well as under the contract-based approach assuming that Sanderson follows Option 2. Include any penalty payment for excess kilometres driven for Option 2.

(h) Based on the results obtained in part (g), provide Sanderson with additional considerations that should be taken into account before making a choice between the different options.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118300855

10th Canadian Edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy