Selected accounts taken from the general ledger of Hampsteads showed the following balances at 31 December. Required

Question:

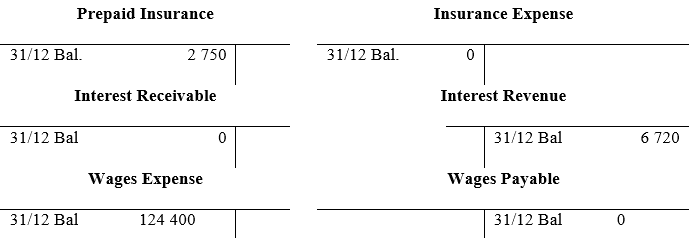

Selected accounts taken from the general ledger of Hampsteads showed the following balances at 31 December.

Required

A. Prepare adjusting entries for the accounts based on the following data that are not yet recorded.

1. Insurance expired during the year, $1400.

2. Wages earned by employees but not paid at year-end, $2280.

3. Interest accrued but not yet received on bills receivable, $580.

B. Open T accounts for each of the accounts listed. Enter the 31 December balances and the adjusting entries.

C. Enter in the appropriate accounts the effects of the closing entries that would be made at year-end.

D. Complete the following table:

Account | Balance before adjustment | Effects of adjusting entries | Balance after adjustments | Effects of closing entries | Balance after closing entries |

Prepaid Insurance | $2 750 | – $1 400 | $1 350 | 0 | $1 350 |

Insurance Expense | |||||

Interest Receivable | |||||

Interest Revenue | |||||

Wages Payable | |||||

Wages Expense | |||||

E. Hampsteads follows the practice of making reversing entries. Prepare the reversing entries that would be made on 1 January of the next period.

F. Record the payment of $2940 in weekly wages on 3 January and the collection of $740 in interest on 18 January. What are the balances in the Wages Expense and Interest Revenue after these entries are posted?

G. Prepare the two entries given in requirement F assuming the company did not prepare reversing entries.

Step by Step Answer:

Accounting

ISBN: 978-1118608227

9th edition

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett