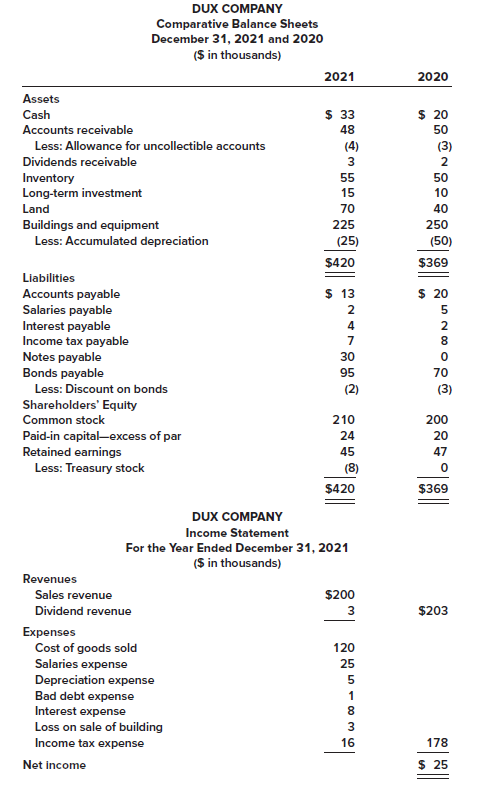

The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given

Question:

The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux?s accounting records is provided also.

Additional information from the accounting records:a. A building that originally cost $40,000, and which was three-fourths depreciated, was sold for $7,000.b. The common stock of Byrd Corporation was purchased for $5,000 as a long-term investment.c. Property was acquired by issuing a 13%, seven-year, $30,000 note payable to the seller.d. New equipment was purchased for $15,000 cash.e. On January 1, 2021, bonds were sold at their $25,000 face value.f. On January 19, Dux issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $14 per share at that time.g. Cash dividends of $13,000 were paid to shareholders.h. On November 12, 500 shares of common stock were repurchased as treasury stock at a cost of $8,000.

Required:Prepare the statement of cash flows of Dux Company for the year ended December 31, 2021. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas