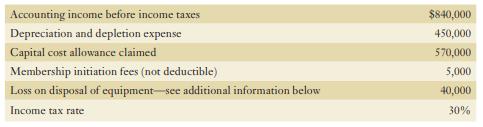

The following information relates to the accounting income for Saskatchewan Uranium Enterprises (SUE) for the current year

Question:

The following information relates to the accounting income for Saskatchewan Uranium Enterprises (SUE) for the current year ended December 31:

During the year, the company sold one of its machines with a carrying value of $60,000 for proceeds of $20,000, resulting in an accounting loss of $40,000. This loss has been included in the pre-tax income figure of $840,000 shown above. For tax purposes, the proceeds from the disposal were removed from the undepreciated capital cost (UCC) of Class 8 assets.

The deferred income tax liability account on January 1 had a credit balance of $150,000. This balance is entirely related to property, plant, and equipment.

Required:

Prepare the journal entries to record income taxes for SUE.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: