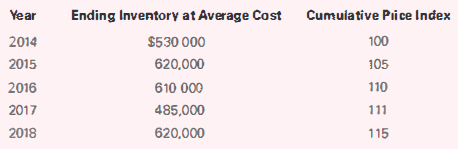

The following information was provided by Capri Company: Capri adopted the dollar-value LIFO method using 2014 as

Question:

The following information was provided by Capri Company:

Capri adopted the dollar-value LIFO method using 2014 as the base year.

Required

a. Compute Capri's ending inventory under the dollar-value LIFO method for the years 2014 through 2018.

b. Prepare the journal entries for 2015 through 2018 to adjust inventory to the dollar-value LIFO basis.

c. Determine the ending balance of the LIFO reserve for 2015 through 2018.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Question Posted: