The Kroger Co, reported cash income taxes paid of $557 million for the year ended January 28,

Question:

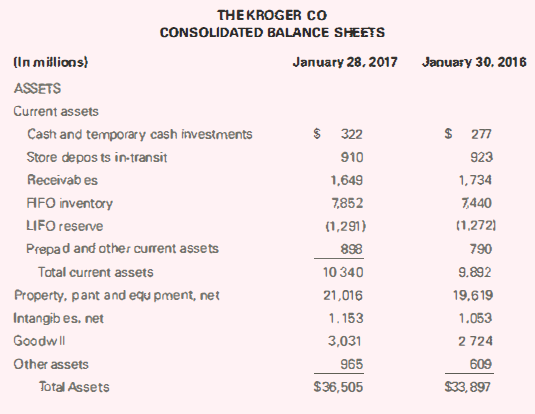

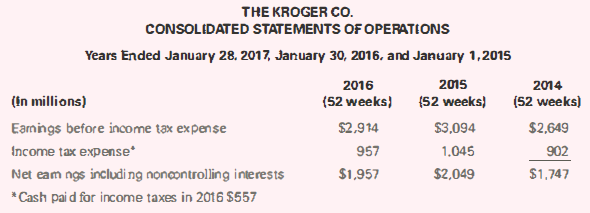

The Kroger Co, reported cash income taxes paid of $557 million for the year ended January 28, 2017 (fiscal year 2016). In addition, it reported the following:

a. What is the LIFO reserve for Kroger as of January 28, 2017? January 30, 2016?

b. What is the impact of Kroger's decision to use LIFO on its January 28, 2017 balance sheet in terms of the effect on inventory, current assets, and total assets?

c. What is the amount of the LIFO effect for Kroger for the year ended January 28, 2017?

d. What is the impact of Kroger's decision to use LIFO on its income statement for the year ended January 28, 2017, in terms of earnings before taxes?

e. What is the impact of Kroger's decision to use LIFO on its cash taxes paid for the year ending January 28, 2017, assuming an effective tax rate of 35%?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella