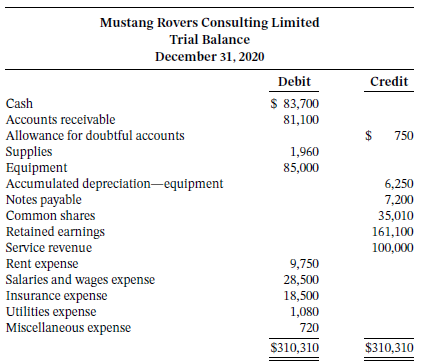

The trial balance and other information for consulting engineers Mustang Rovers Consulting Limited follow: Additional information: 1.

Question:

The trial balance and other information for consulting engineers Mustang Rovers Consulting Limited follow:

Additional information:

1. Service revenue includes fees received in advance from clients of $6,900.

2. Services performed for clients that were not recorded by December 31 totalled $7,300.

3. Bad debt expense for the year is $6,300.

4. Insurance expense includes a premium paid on December 31 in the amount of $6,000 for the period starting on January 1, 2021.

5. Equipment is depreciated on a straight-line basis over 10 years. Residual value is $15,000.

6. Mustang gave the bank a 90-day, 12% note for $7,200 on December 1, 2020.

7. Rent is $750 per month. The rent for 2020 and for January 2021 has been paid.

8. Salaries and wages earned but unpaid at December 31, 2020, are $2,598.

9. Dividends of $80,000 were declared on December 15, 2020 for payment on February 1, 2021.

Instructions

a. From the trial balance and other information given, prepare annual adjusting entries as at December 31, 2020. Round amounts to the nearest dollar.

b. Prepare an adjusted trial balance for Mustang Rovers as at December 31, 2020.

c. Prepare an income statement for 2020, a statement of financial position as at December 31, 2020, and a statement of retained earnings for 2020.

d. Explain how the financial statements in part (c) would change if Mustang Rovers operated as a sole proprietorship, rather than a corporate ownership structure.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy