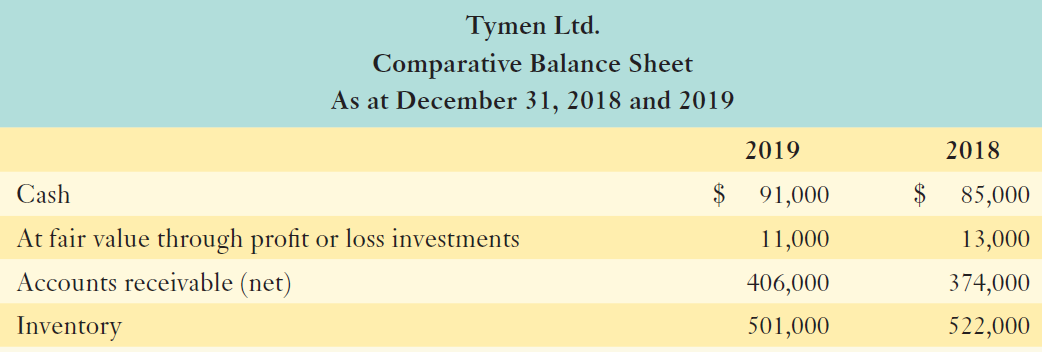

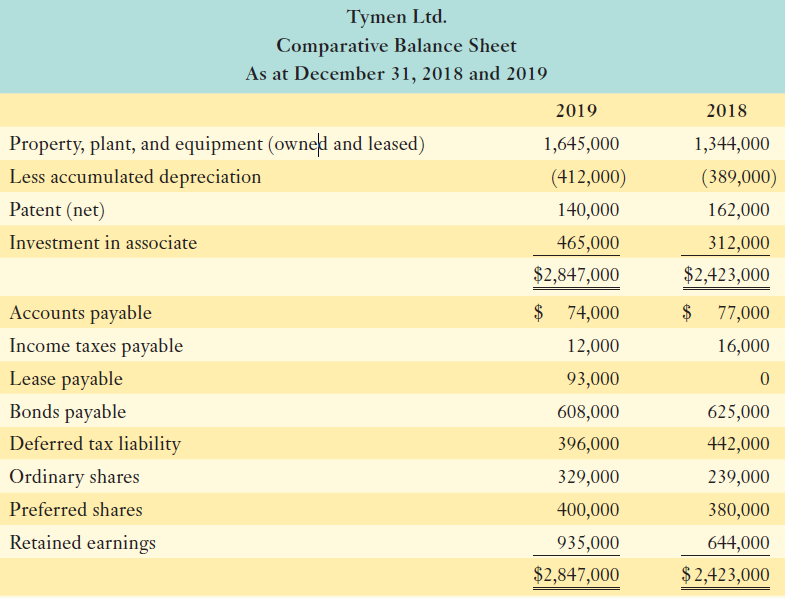

Tymens financial statements as at December 31, 2019, appear below (PPE denotes property, plant, and equipment): Tymen

Question:

Tymen Ltd.

Income Statement

For the Year Ended December 31, 2019

Sales .................................................................................. $3,218,575

Cost of goods sold ........................................................... 1,649,125

Gross profit ....................................................................... 1,569,450

Depreciation of PPE .......................................................... 318,700

Patent impairment ............................................................ 40,000

Interest expense€”bonds ................................................. 36,000

Interest expense€”finance lease ...................................... 4,500

Other expenses .................................................................. 735,750

Operating income ............................................................... 434,500

Investment income€”associate ......................................... 288,000

Income before income taxes ............................................. 722,500

Income taxes ....................................................................... 293,000

Net income .......................................................................... $ 429,500

Additional information:

- Tymen has adopted a policy of classifying cash inflows and outflows from interest and dividends as operating activities.

- Tymen did not elect to designate its at fair value through profit or loss investments as cash equivalents.

- Tymen accounts for its investment in an associate using the equity method.

- The company nets many items to €œOther Expenses€; for example, gains and losses on fixed asset sales.

- During the year Tymen acquired PPE with a fair value of $100,000 under a finance lease.

- 90,000 ordinary shares and 10,000 preferred shares were issued to acquire $110,000 of PPE.

- Tymen successfully defended its right to a patent. Related expenditures totalled $18,000.

- The decrease in the bonds payable account was due to the amortization of the premium.

- Property, plant, and equipment costing $420,000 was sold for $75,000.

Required:

a. Prepare a statement of cash flows for Tymen Ltd. for 2019 using the indirect method.

b. Identify what supplemental disclosure, if any, is required.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: