Using the information in P4-6 and P4-7, perform the following steps for Tides Tea Company: Data from

Question:

Using the information in P4-6 and P4-7, perform the following steps for Tides Tea Company:

Data from P4-6

Tides Tea Company began operations on January 1, 2018. During the first year of business, the company had the following transactions:

• January 18: The owners invested $200,000 (the par value of the stock) into the business and acquired 40,000 shares of common stock in return.

• February 1: Tides bought factory equipment in the amount of $45,000. The company rook out a long-term note from the bank to finance the purchase.

• February 28: The company paid cash for rent to cover the 12-month period from March 1, 2018, through February 29, 2019, in the amount of $27,000.

• Match 1: Tides purchased supplies in the amount of $28,000 on account.

• March 22: Tides recorded sales revenue in the amount of $120,000. Half of this amount was received in cash and half was paid on account. Ignore cost of goods sold.

• May 1: Tides received cash payments 10 pay off all the customer accounts.

• May 29: The company paid wages of $34,000 in cash.

• July 12: Tides recorded sales revenue in the amount of $180,000, all of which was paid in cash. Ignore cost of goods sold.

• July 31: Tides paid $3,200 cash for interest on the note taken out on February 1.

• August 8: Tides paid off the balance owed to a supplier for the purchase made on March 1.

• September 1: Tides paid $6,000 cash for utilities.

• October 14: Tides paid wages of $24,000 in cash.

• November 10: Tides recorded sales revenue in the amount of $218,000. One payment of $100,000 was received in cash; the remainder of this balance was sold on account. Ignore cost of goods sold.

• December 31: Tides declared and paid a $25,000 dividend.

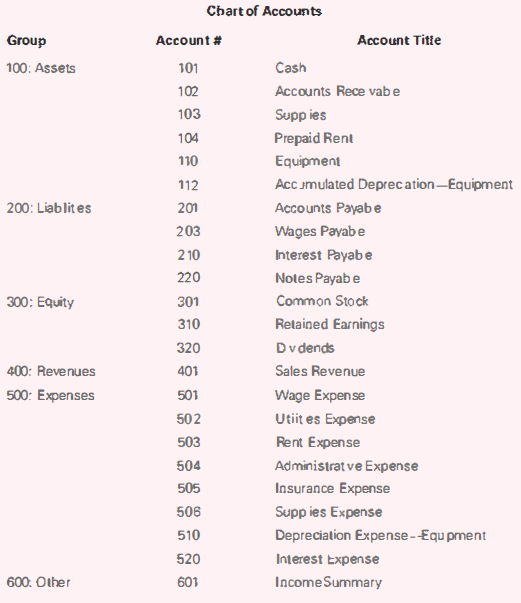

The chart of accounts used by Tides Tea Company is as follows:

Required

a. Journalize and post the necessary closing entries. Omit explanations.

b. Prepare a post-closing trial balance as of December 31.

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella