With declining demand and sales. the last several years have been challenging in the global auto industry.

Question:

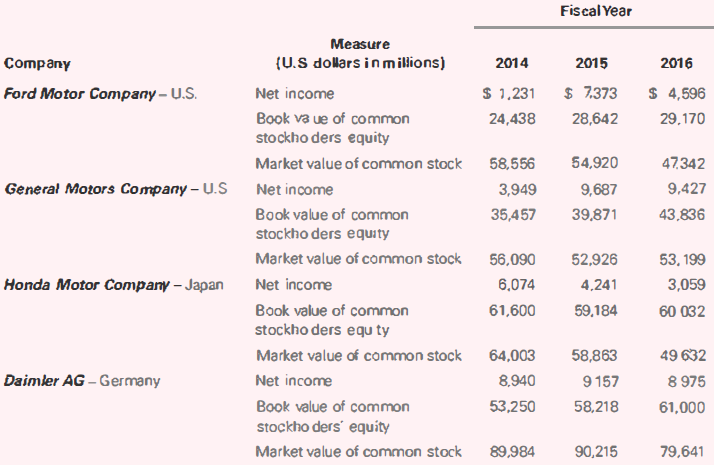

With declining demand and sales. the last several years have been challenging in the global auto industry. You are interested in better understanding the performance and valuation of major global companies in the industry. The following table presents net income for the year and shareholders' equity and market value at the end o f each fiscal year for four global auto companies.

Required

a. Comment on changes in net income and book values of each year.

b. Compute the price-earnings (P/E) ratios and price-to-book (P/B) ratios for each year.

c. Compute an average of price-earnings (P/E) ratios and price-to-book (P/B) ratios for each year.

d. Comment on the companies' P/E ratios over time. Are there any unusually high or low P/E ratios? If so, why? Comment on the average over time.

e. Why would the P/8 ratios in the automotive industry generally be higher than 1? Are there any unusually high or low P/B ratios? If so, why? Comment on the companies P/B ratios over time. Comment on the average over time.

f. Compare the average P/E and P/B ratios for the pharmaceutical companies from Example 15,23 in the text with those in the auto industry.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella