York Co. sells one product, which it purchases from various suppliers. York?s trial balance at December 31,

Question:

York Co. sells one product, which it purchases from various suppliers. York?s trial balance at December 31, 2021, included the following accounts:

Sales (33,000 units @ $16) ..................$528,000Sales discounts ..........................................7,500Purchases ..............................................368,900Purchase discounts ................................18,000Freight-in ..................................................5,000Freight-out .............................................11,000

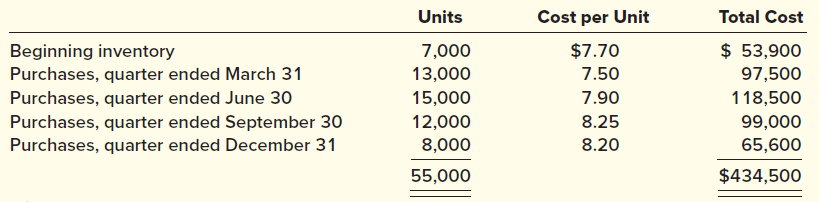

York Co.?s inventory purchases during 2021 were as follows:

Additional Information:a. York?s accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method.b. York has determined that, at December 31, 2021, the net realizable value was $8.00 per unit.

Required:1. Prepare York?s schedule of cost of goods sold, with a supporting schedule of ending inventory. York includes inventory write-down losses in cost of goods sold.2. Determine whether inventory should be reported at cost or net realizable value.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas