You are interested in further analyzing and comparing the liquidity of Pfizer Inc., and Johnson & Johnson

Question:

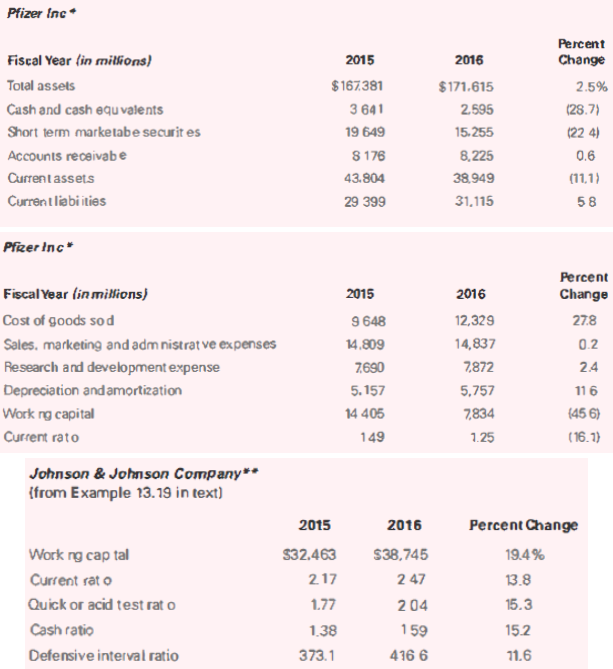

You are interested in further analyzing and comparing the liquidity of Pfizer Inc., and Johnson & Johnson Company. In an earlier analysis in Appendix B of Chapter 6, you found the current ratios of both companies at the end of fiscal year 2016 were above the threshold of 1 at 1.25 for Pfizer and 2.47 for Johnson & Johnson. In the Chapter 13 Financial Statement Analysis case, you assessed additional measures of Johnson & Johnson's liquidity, which follow. Using information from the 2015 and 2016 financial Statements for Pfizer, answer the following questions about the company's liquidity and then compare the two companies.

a. Compute Pfizer's quick ratio for each year.

b. Compute Pfizer's cash ratio for each year.

c. Compute Pfizer's defensive interval ratio for each year.

d. Comment on changes in Pfizer's liquidity from 2015 to 2016 based on the ratios computed.

e. Compare the changes in Pfizer's liquidity from 2015 to 2016 to those computed in Example 13.19 in the text for Johnson & Johnson. The following tables are included for the comparison.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella