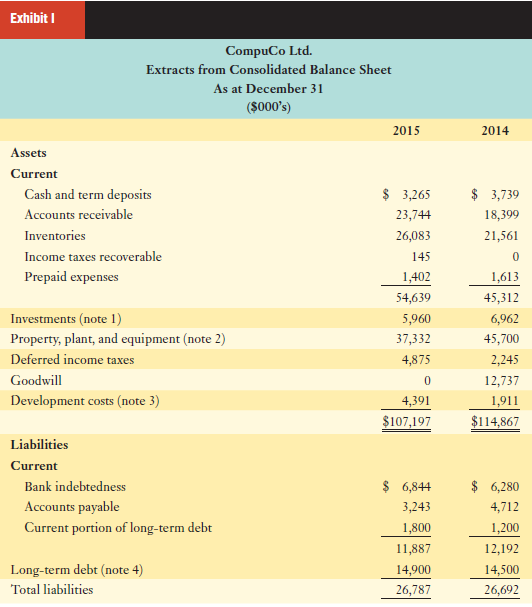

You have been asked to prepare a statement of cash flows using the balance sheet provided in

Question:

Required:

1. Use the indirect method to prepare a statement of cash flows for 2015 on a non comparative basis in good form from the information provided.

2. Use the direct method to prepare the cash flows from operations section of the statement of cash flows for 2015.

3. What are the objectives of a statement of cash flows prepared in accordance with generally accepted accounting principles?

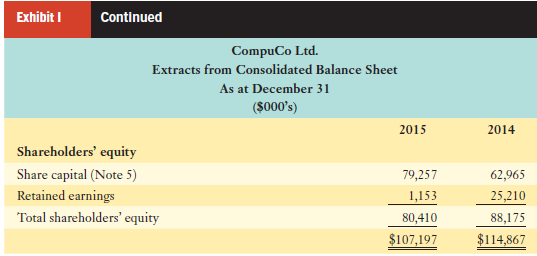

CompuCo Ltd.

Extracts from Notes to Financial Statements

F or the Year Ended December 31

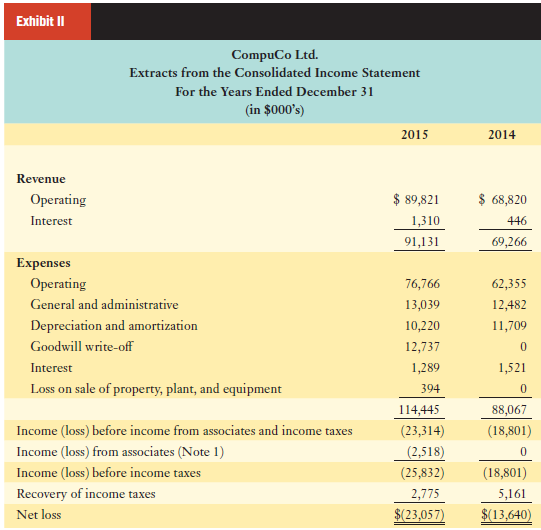

1. Investments

The company€™s investments at December 31 are as follows:

2015 2014

(in $000€™s)

XYZ Inc. (market value 2015, $8.3 million)

Shares .......................................................................................................... $ 5,962 $ 5,962

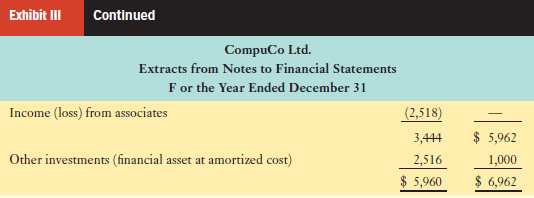

2. Property, plant, and equipment (PPE)

Additions to PPE for the current year amounted to $2.29 million and proceeds from the disposal of PPE amounted to $250,000.

3. Development costs

Development costs for a product are amortized once the product is ready for market. The rate depends on the expected life of the product.

4. Long-term debt

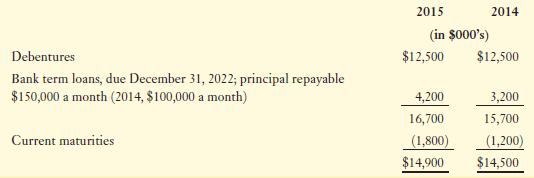

Debentures bear interest at 12% per annum and are due in 2018. Bank term loans bear interest at 8% and the bank advanced $2.2 million during the year.

5. Share capital

On May 14, 2015, CompuCo Ltd. issued 3.8 million shares with special warrants. Net proceeds from issuing 3.8 million shares amounted to $14.393 million. Net proceeds from issuing 3.8 million warrants amounted to $899,000. On December 31, 2015, a stock dividend of $1 million was issued.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: