AGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and

Question:

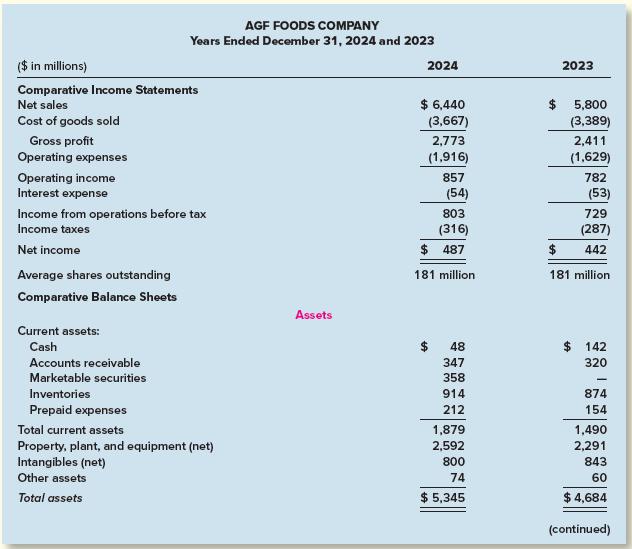

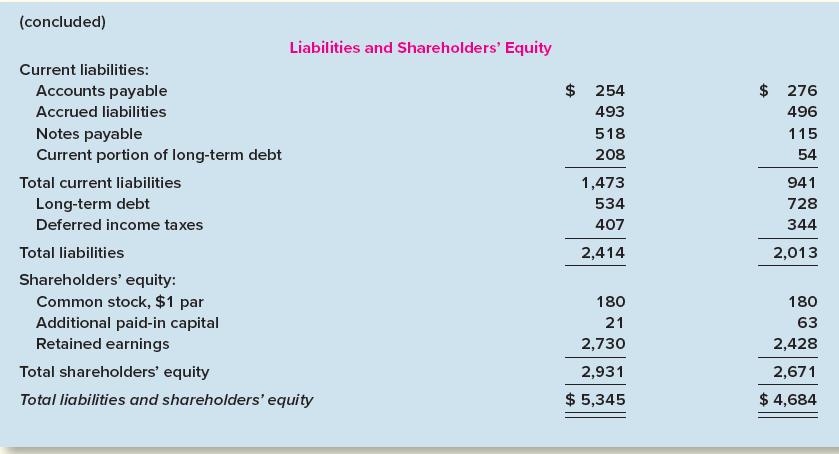

AGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial Financial Ratios and Dun and Bradstreet’s Industry Norms and Key Business Ratios. Following are the 2024 and 2023 comparative income statements and balance sheets for AGF. The market price of AGF’s common stock is $47 at the end of 2024. (The financial data we use are from actual financial statements of a well-known corporation, but the company name used in our illustration is fictitious and the numbers and dates have been modified slightly to disguise the company’s identity.) Profitability is the key to a company’s long-run survival. Profitability measures focus on a company’s ability to provide an adequate return relative to resources devoted to company operations.

Required:

1. Calculate the return on shareholders’ equity for AGF. The average return for the stocks listed on the New York Stock Exchange in a comparable period was 18.8%.

2. Calculate the return on assets for AGF.

3. Calculate AGF’s earnings per share. The average return for the stocks listed on the New York Stock Exchange in a comparable time period was 5.4%.

4. Calculate AGF’s earnings-price ratio.

Step by Step Answer: