Differences between pretax accounting income and taxable income were as follows during 2024: The cumulative temporary difference

Question:

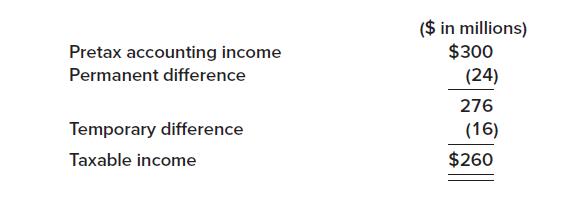

Differences between pretax accounting income and taxable income were as follows during 2024:

The cumulative temporary difference as of the end of 2024 is $40 million (also the future taxable amount). The enacted tax rate is 25%. What is the deferred tax asset or liability to be reported in the balance sheet?

Transcribed Image Text:

Pretax accounting income Permanent difference Temporary difference Taxable income ($ in millions) $300 (24) 276 (16) $260

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Since the cumulative temporary difference between pretax accounting income and taxable income ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Differences between pretax accounting income and taxable income were as follows during 2021: ($ in millions) Pretax accounting income.....................................$ 300 Permanent...

-

Differences between pretax accounting income and taxable income were as follows during 2021 (5 ir eillions) $ 440 (38) 482 Pretax accounting incone Permanent difference Tomporary difference (30) $...

-

What are the upper and lower 2.5th percentiles for a chi-square distribution with 2 df? What notation is used to denote these percentiles? Pulmonary Disease The data in Table 6.10 concern the mean...

-

What is the main distinction between the M1 and M2 definitions of money?

-

Decide whether or not each equation has a circle as its graph. If it does, give the center and the radius. x 2 + y 2 - 4x + 2y = 4

-

The John Gore Organization owns and operates the Charles Playhouse, a theater in Boston, Massachusetts. Evelyn Castillo has diabetes, a disability under the Americans with Disabilities Act (ADA)....

-

Selected account balances before adjustment for Heartland Realty at August 31, 2014, the end of the current year, are as follows: Data needed for year-end adjustments are as follows: a. Unbilled fees...

-

a.) The following questions refer to the optical cavity in the diagram below. It is excited by a variable frequency source and the detected intensity is displayed on an Optical Spectrum Analyzer....

-

The income statement of Fezzik's Shoe Repair is as follows: On April 1, the Owner's Capital account had a balance of $12,900. During April, Fezzik withdrew $3,000 cash for personal use. Prepare...

-

Refer to the situation described in BE 165. Suppose the deferred portion of the rent collected was $40 million at the end of 2025. Taxable income is $200 million. Prepare the appropriate journal...

-

You are the new accounting manager at the Barry Transport Company. Your CFO has asked you to provide input on the companys income tax position based on the following: 1. Pretax accounting income was...

-

Chloe and Zions home lot is illustrated here. They wish to hire a lawn service to cut their lawn. M&M Lawn Service charges $0.03 per square yard of lawn. How much will it cost them to have their lawn...

-

TFC TVC TC AFC AVC ATC MC 0 50 0 50 1 2 50 20 3 50 90 5 50 100 50 70 70 F 190 12.50 G 18) What is the value for E? 30 40 30 30 40 40 47.50 E 60 50 13

-

A force of 49.0 N is used to push a 6.00 kg box down a 17 incline. There is a coefficient of kinetic friction of 0.425. Determine the acceleration of the box. Give your answer in 3 significant...

-

A 2kg object moves on the path shown in the figure.It is released from the point A and moves towards point B. When it reaches the point B, it has a speed of 5m.s-. 3m 5m/s 1m B

-

A student calculated the final velocity of a train that decelerated from 3 0 . 5 m / s and got an answer of - 4 3 . 5 6 m / s . What might indicate that he made a mistake in his calculation?

-

Income Tax Bracket Marginal Tax Rate $ 0 minus 8 , 0 0 0 1 2 % 8 , 0 0 1 minus 2 2 , 0 0 0 1 7 % 2 2 , 0 0 1 minus 4 8 , 0 0 0 2 5 % 4 8 , 0 0 1 and over 3 8 % The table shows the income tax brackets...

-

The population is P(t) = 2.0 x 106 + 2.0 x 104t, and the mass per person W(t) is W(t) = 80 - 0.005t2. The total mass of a population (in kg) as a function of the time, t, is the product of the number...

-

The liquidliquid extractor in Figure 8.1 operates at 100F and a nominal pressure of 15 psia. For the feed and solvent flows shown, determine the number of equilibrium stages to extract 99.5% of the...

-

Kroger Co. is one of the largest retail food companies in the United States as measured by total annual sales. The Kroger Co. operates supermarkets, convenience stores, and manufactures and processes...

-

The following is a portion of the January 31, 2009 and 2008, balance sheets ofMacy's, Inc.: Macy's debt to equity ratio for the year ended January 31, 2009 was 3.8, calculated as $17,499 $4,646....

-

Russell-James Corporation is a diversified consumer products company. During 2011, Russell-James discontinued its line of cosmetics, which constituted discontinued operations for financial reporting...

-

27. A person has 36 coins, all of which are nickels dimes, and quarters. If there are twice as many dimes as nickels and if the face value of the coins is $4, how many of each type of coin must this...

-

Burger name Cheeseburger Baconator 4. The fat content (in grams) and the calorie counts of five fast-food burgers are shown in the data table below. Restaurant McDonald's Wendy's Fat content (grams)...

-

4 A player has 3 dollars. At each play of a game, he loses a dollar with a probability of 3/4 but wins 2 dollars with probability of 1/4. He stops playing if he has lost his 3 dollars or he has won...

Study smarter with the SolutionInn App