Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The

Question:

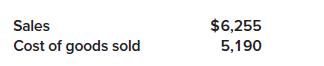

Inverness Steel Corporation is a producer of flat-rolled carbon, stainless and electrical steels, and tubular products. The company’s income statement for the 2024 fiscal year reported the following information ($ in millions):

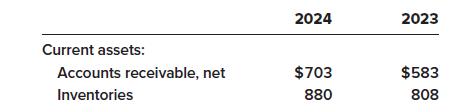

The company’s balance sheets for 2024 and 2023 included the following information ($ in millions):

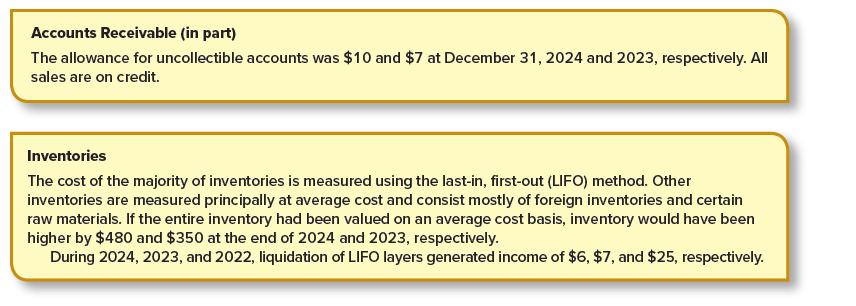

The statement of cash flows reported bad debt expense for 2024 of $8 million. The summary of significant accounting policies included the following notes ($ in millions):

Required:

Using the information provided:

1. Determine the amount of accounts receivable Inverness wrote off during 2024.

2. Calculate the amount of cash collected from customers during 2024.

3. Calculate what cost of goods sold would have been for 2024 if the company had used average cost to value its entire inventory.

4. Calculate the following ratios for 2024:

a. Receivables turnover ratio

b. Inventory turnover ratio

c. Gross profit ratio

5. Explain briefly what caused the income generated by the liquidation of LIFO layers. Assuming an income tax rate of 25%, what was the effect of the liquidation of LIFO layers on cost of goods sold in 2024?

Step by Step Answer: