Millington Materials is a leading supplier of building equipment, building products, materials, and timber for sale, with

Question:

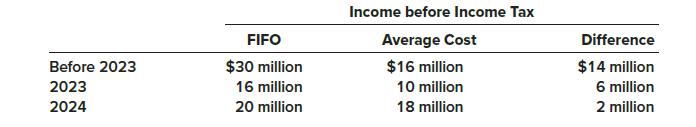

Millington Materials is a leading supplier of building equipment, building products, materials, and timber for sale, with over 200 branches across the Mid-South. On January 1, 2024, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 25%.

Required:

1. Prepare the journal entry to record the change in accounting principle.

2. Determine the net income to be reported in the 2024–2023 comparative income statements.

3. Which other 2023 amounts would be reported differently in the 2024–2023 comparative income statements and 2024–2023 comparative balance sheets than they were reported the previous year?

4. How would the change be reflected in the 2024–2023 comparative statements of shareholders’ equity assuming cash dividends were $2 million each year and that no dividends were paid prior to 2023?

Step by Step Answer: