Refer to the facts in P 109 but now assume the $3 million loan is not specifically

Question:

Refer to the facts in P 10–9 but now assume the $3 million loan is not specifically tied to construction of the building. Using the weighted-average interest method, answer the following questions:

Data from in P 10-9

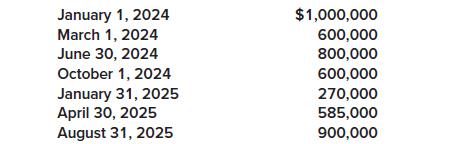

On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows:

On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2024 and 2025. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company’s fiscal year-end is December 31.

Requirement

1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the weighted-average method.

2. What is the total cost of the building?

3. Calculate the amount of interest expense that will appear in the 2024 and 2025 income statements.

Step by Step Answer: