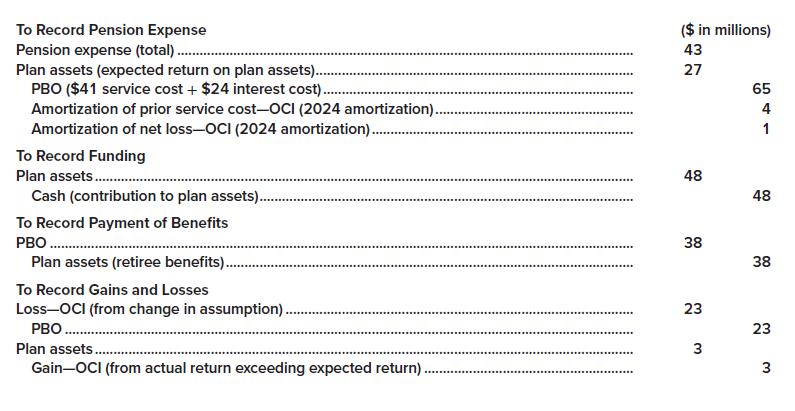

Reproduced below are the journal entries related to Illustration 1712 in this chapter that Global Communications used

Question:

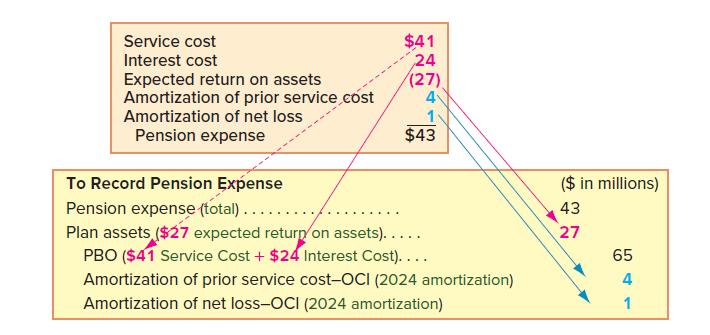

Reproduced below are the journal entries related to Illustration 17–12 in this chapter that Global Communications used to record its pension expense and funding in 2024 and the new gain and loss that occurred that year. To focus on the core issues, we ignored the income tax effects of the pension amounts.

Data from in illustration 17-12

Required:

1. Recast these journal entries to include the income tax effects of the events being recorded. Assume that Global’s tax rate is 25%. (Hint: Costs are incurred and recognized for financial reporting purposes now, but the tax impact comes much later—when these amounts are deducted for tax purposes as actual payments for retiree benefits occur in the future. As a result, the tax effects are deferred, creating the need to record deferred tax assets and deferred tax liabilities. So, you may want to refer back to Chapter 16 to refresh your memory on these concepts.)

2. Prepare a statement of comprehensive income for 2024, assuming Global’s only other sources of comprehensive income were net income of $300 million and a $30 million unrealized holding gain on investments in securities available for sale.

Step by Step Answer: