Stacy Persoff is the newly hired assistant controller of Kemp Industries, a regional supplier of hardwood derivative

Question:

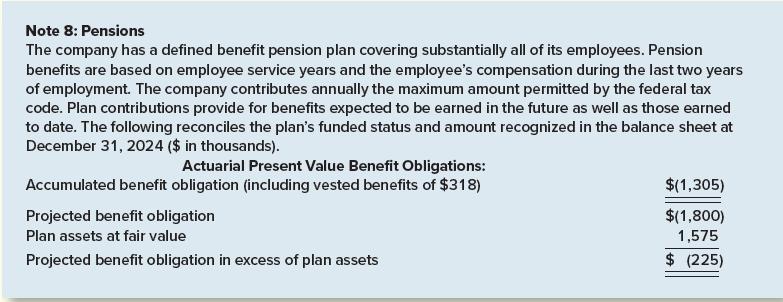

Stacy Persoff is the newly hired assistant controller of Kemp Industries, a regional supplier of hardwood derivative products. The company sponsors a defined benefit pension plan that covers its 420 employees. On reviewing last year’s financial statements, Persoff was concerned about some items reported in the disclosure notes relating to the pension plan. Portions of the relevant note follow:

Kemp’s comparative income statements reported total pension expense of $108,000 in 2024 and $86,520 in 2023. Since employment has remained fairly constant in recent years, Persoff expressed concern over the increase in the pension expense. She expressed her concern to you, a three-year senior accountant at Kemp. “I’m also interested in the differences in these liability measurements,” she mentioned.

Required:

Write a memo to Persoff. In the memo, do the following:

1. Explain to Persoff how the composition of the total pension expense can create the situation she sees. Briefly describe the components of pension expense. Include a description of how the service cost component is reported in the income statement.

2. Briefly explain how pension gains and losses are recognized in earnings.

3. Describe for her the differences and similarities between the accumulated benefit obligation and the projected benefit obligation.

4. Explain how the “Projected benefit obligation in excess of plan assets” is reported in the financial statements.

Step by Step Answer: