The Heinrich Tire Company recalled a tire in its subcompact line in December 2024. Costs associated with

Question:

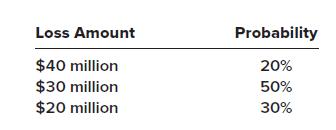

The Heinrich Tire Company recalled a tire in its subcompact line in December 2024. Costs associated with the recall were originally thought to approximate $50 million. Now, though, while management feels it is probable the company will incur substantial costs, all discussions indicate that $50 million is an excessive amount. Based on prior recalls in the industry, management has provided the following probability distribution for the potential loss:

An arrangement with a consortium of distributors requires that all recall costs be settled at the end of 2025. The risk-free rate of interest is 5%.

Required:

1. By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2024 for the loss and contingent liability?

2. For the remainder of this problem, apply the expected cash flow approach of SFAC No. 7. Estimate Heinrich’s liability at the end of the 2024 fiscal year.

3. Prepare the journal entry to record the contingent liability (and loss).

4. Prepare the journal entry to accrue interest on the liability at the end of 2025.

5. Prepare the journal entry to pay the liability at the end of 2025, assuming the actual cost is $31 million. Heinrich records an additional loss if the actual costs are higher or a gain if the costs are lower.

Step by Step Answer: