You are a new staff accountant with a large regional CPA firm, participating in your first audit.

Question:

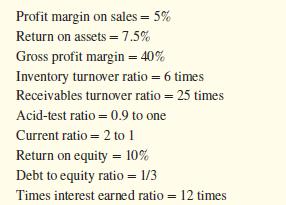

You are a new staff accountant with a large regional CPA firm, participating in your first audit. You recall from your auditing class that CPAs often use ratios to test the reasonableness of accounting numbers provided by the client. Since ratios reflect the relationships among various account balances, if it is assumed that prior relationships still hold, prior years’ ratios can be used to estimate what current balances should approximate. However, you never actually performed this kind of analysis until now. The CPA in charge of the audit of Covington Pike Corporation brings you the list of ratios shown below and tells you these reflect the relationships maintained by Covington Pike in recent years.

Jotted in the margins are the following notes:

• Net income $15,000.

• Only one short-term note ($5,000); all other current liabilities are trade accounts.

• Property, plant, and equipment are the only noncurrent assets.

• Bonds payable are the only noncurrent liabilities.

• The effective interest rate on short-term notes and bonds is 8%.

• No investment securities.

• Cash balance totals $15,000.

Required:

You are requested to approximate the current year’s balances in the form of a balance sheet and income statement, to the extent the information allows. Accompany those financial statements with the calculations you use to estimate each amount reported.

Step by Step Answer: