An asset which cost £200,000 on 1 January 2016 is being depreciated on the straight line basis

Question:

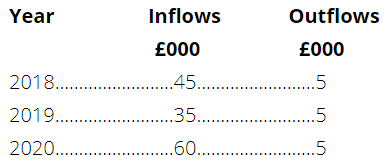

The cash inflow for 2020 includes the estimated residual value of £40,000. The asset could be sold on 31 December 2017 for £110,000. Disposal costs would be £6,000.

(a) Determine the asset's value in use, assuming that all cash flows occur at the end of the year concerned and using a discount rate of 8%.

(b) Determine the asset's recoverable amount.

(c) Calculate the amount of the impairment loss that has occurred and explain how this should be accounted for.

(d) Calculate the amount of depreciation that should be charged in relation to the asset for each of the remaining years of its useful life.

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville

Question Posted: