The following draft financial statements are available for Sipfalor plc for the year ended 31 May 2018:

Question:

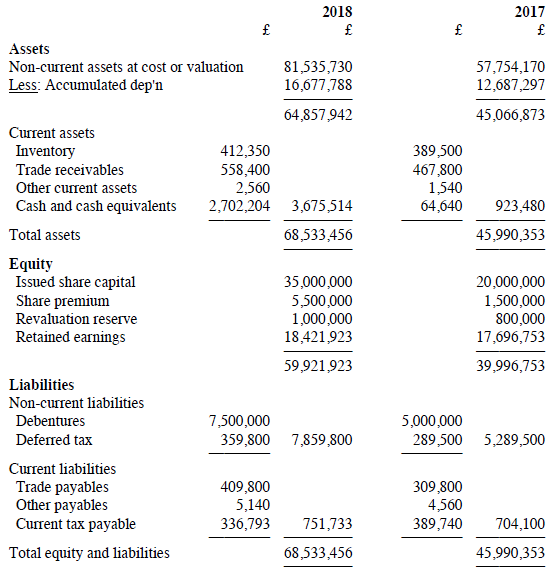

Statement of financial position at 31 May 2018.

Statement of profit or loss for the year to 31 May 2018.

£

Revenue.............................................. 43,380,756

Cost of sales..................................... (25,050,812)

€“€“€“€“€“€“€“€“€“€“

Gross profit.......................................... 18,329,944

Operating expenses.......................... (15,833,481)

€“€“€“€“€“€“€“€“€“€“

Operating profit.....................................2,496,463

Interest paid........................................... (812,500)

€“€“€“€“€“€“€“€“€“€“

Profit before tax................................... 1,683,963

Taxation................................................... (278,793)

€“€“€“€“€“€“€“€“€“€“

Profit for the year................................ 1,405,170

€“€“€“€“€“€“€“€“€“€“

Sipfalor plc presents a separate statement of profit or loss for the year (as above) and a separate statement of comprehensive income.

The following additional information for the year ended 31 May 2018 is available:

1). Dividends paid during the year were £680,000.

2). Non-current assets which had cost £332,100 and which had a carrying value of £55,940 were sold for £45,000. Any surpluses or deficits on the disposal of noncurrent assets have been included in the depreciation charge for the year. Other movements in non-current assets are due to purchases of new assets and revaluations.

3). "Other current assets" consists of prepaid insurance. "Other payables" consists of accrued wages and salaries.

Required:

Prepare a statement of cash flows for Sipfalor plc for the year ended 31 May 2018 in accordance with IAS7 Statement of Cash Flows using the direct method. Additional notes are not required. Ignore VAT.

(CIPFA)

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville