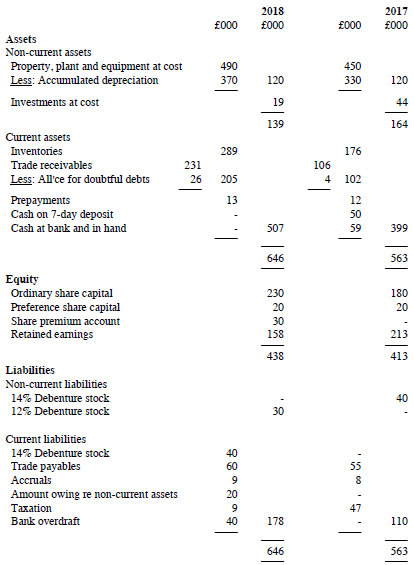

The statement of financial position of Urbax plc at 31 July 2018 (with comparatives for the previous

Question:

The statement of financial position of Urbax plc at 31 July 2018 (with comparatives for the previous year) is shown below:

Statement of financial position at 31 July 2018.

(i) Equipment which had cost ?30,000 during the year to 31 July 2015 was sold in February 2018 for ?10,000. The company depreciates equipment at 20% per annum on cost with a full charge in the year of acquisition and none in the year of disposal. (Some of the equipment was over five years old on 31 July 2018).

(ii) Non-current asset investments which had cost ?25,000 some years previously were sold during the year for ?21,000.

(iii) Dividends received during the year were ?5,000. Dividends totalling ?100,000 were paid during the year.

(iv) The 14% debentures were issued many years ago and are due to be redeemed on 1 January 2019. A fresh issue of 12% debentures was made on 31 July 2018.?

(v) Interest paid during the year (including debenture interest) was ?8,000. All interest was paid on the due date and no interest was accrued at either the start or the end of the year. No interest was received during the year.

(vi) Taxation shown as a liability on 31 July 2017 was paid during the year to 31 July 2018 at the amount stated.

(vii) In January 2018, the company issued 50,000 ?1 ordinary shares at a premium of 60p per share.

(viii) The cash on 7-day deposit ranks as a cash equivalent.

Required:

(a) Calculate the company's profit before tax for the year to 31 July 2018.

(b) Prepare a statement of cash flows for the year to 31 July 2018 in accordance with the requirements of IAS7 (using the indirect method).

(c) Reconcile the total cash and cash equivalents shown by the statement of cash flows to the equivalent figures shown in the opening and closing statements of financial position.

(d) Comment briefly on the significance of the information provided by the company's statement of cash flows.

DebenturesDebenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville