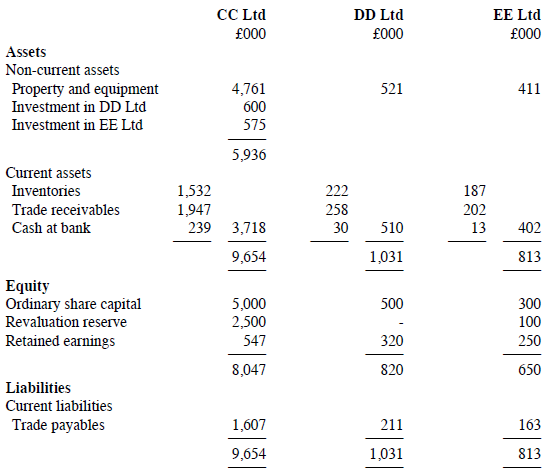

The statements of financial position of CC Ltd and its two subsidiaries DD Ltd and EE Ltd

Question:

The following information is available:

(a) CC Ltd acquired 60% of the shares of DD Ltd on 1 January 2016, when DD Ltd had retained earnings of £280,000. The fair value of the property and equipment of DD Ltd on that date was £30,000 more than book value. This valuation has not been reflected in the books of DD Ltd.

(b) CC Ltd acquired 90% of the shares of EE Ltd on 1 January 2017, when EE Ltd had a revaluation reserve of £60,000 and retained earnings of £230,000. The fair value of EE Ltd's assets and liabilities on that date was equal to their book value.

(c) Neither DD Ltd nor EE Ltd have issued any shares since being acquired by CC Ltd.

(d) Goodwill arising on consolidation in relation to DD Ltd has suffered an impairment loss of 50% since the date of acquisition. The impairment loss for EE Ltd is 25%.

(e) The following intra-group balances exist on 31 December 2017:

- DD Ltd owes CC Ltd £15,000.

- EE Ltd owes CC Ltd £25,000.

- EE Ltd owes DD Ltd £8,000.

All of these balances are included in trade receivables and payables.

(f) Goods purchased for £8,000 from CC Ltd are included in DD Ltd's inventory at 31 December 2017. CC Ltd had invoiced these goods to DD Ltd at cost plus 60%.

(g) Any depreciation consequences of the fair value adjustment relating to the property and equipment of DD Ltd may be ignored.

Required:

Prepare a consolidated statement of financial position as at 31 December 2017.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville