The summarised statement of comprehensive income of Scharp Ltd for the year to 30 June 2018 is

Question:

The summarised statement of comprehensive income of Scharp Ltd for the year to 30 June 2018 is shown below, together with the company's statement of financial position at that date (with comparatives for the previous year).

Statement of comprehensive income for the year to 30 June 2018.

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?Operating profit......................... ?170,200Investment income......................... 7,100Interest payable............................ (6,120)? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ????????Profit before taxation................. 171,180Taxation......................................... 37,870? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ????????Profit for the year........................ 133,310? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ???????

Other comprehensive income was ?nil.

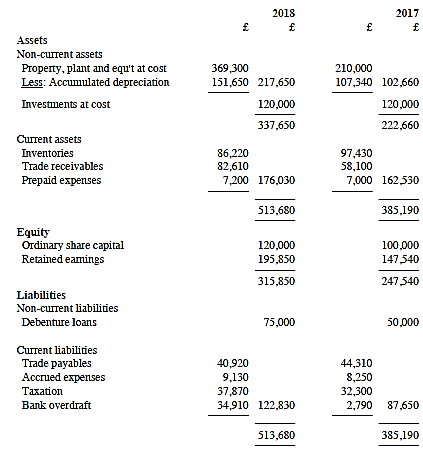

Statement of financial position at 30 June 2018.

(i) There were no disposals of non-current assets during the year to 30 June 2018.

(ii) A dividend of ?85,000 was paid during the year.

Required:

(a) Prepare a statement of cash flows for the year to 30 June 2018 in accordance with the requirements of IAS7 (using the indirect method).

(b) Explain why the information provided in the statement of comprehensive income and in the statements of financial position is insufficient to allow use of the direct method in this case.

(c) Comment briefly on the significance of the information provided by the company's statement of cash flows.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville