You have been asked to help prepare the financial statements of Tanhosier Ltd for the year ended

Question:

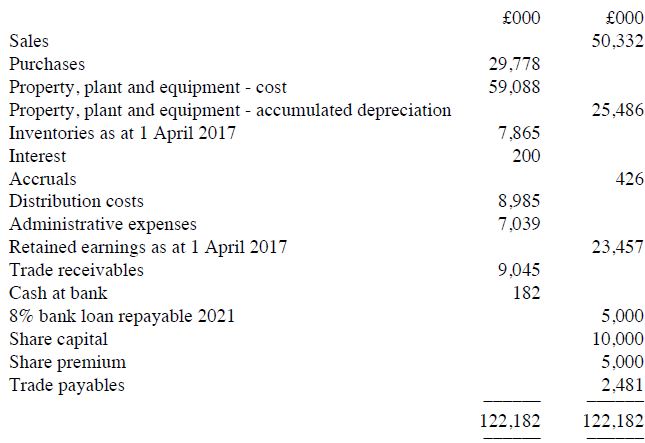

You have been asked to help prepare the financial statements of Tanhosier Ltd for the year ended 31 March 2018. A trial balance as at 31 March 2018 is shown below.

The following further information is available:

(i) The share capital of the company consists of ordinary shares with a nominal value of ?1 each.

(ii) No dividends are to be paid for the current year.

(iii) The sales figure in the trial balance includes sales made on credit for April 2018 amounting to ?3,147,000.

(iv) The inventories at the close of business on 31 March 2018 cost ?8,407,000. Included in this figure are inventories that cost ?480,000, but which can be sold for only ?180,000.

(v) Transport costs of ?157,000 relating to March 2018 are not included in the trial balance as the invoice was received after the year end.

(vi) Interest on the bank loan for the last six months of the year has not been included in the trial balance.

(vii) The corporation tax charge for the year has been calculated as ?235,000.?

Draft the statement of comprehensive income of Tanhosier Ltd for the year to 31 March 2018 and a statement of financial position at that date.?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville