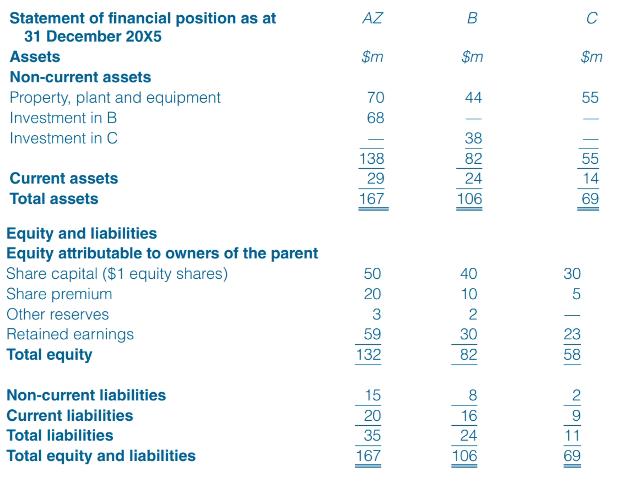

Extracts from the financial statements of AZ, B and C are presented below. Additional information: 1. AZ

Question:

Extracts from the financial statements of AZ, B and C are presented below.

Additional information:

1. AZ acquired 80 per cent of the equity share capital of B on 1 January 20X2 when the retained earnings of B were $23 million and the balance on B’s other reserves was nil. This acquisition resulted in AZ having power over B and AZ used that power to affect its return from the investment. B has not issued any shares since the acquisition date. The non-controlling interest in B was measured at fair value at the date of acquisition. The fair value of one equity share in B was $2.25 on 1 January 20X2.

2. B acquired 75 per cent of the equity share capital of C on 1 January 20X4 when the retained earnings of C were $8 million and the balance on C’s other reserves was nil. This acquisition resulted in B having power over C and B used that power to affect its return from the investment. C has not issued any shares since the acquisition date. The non-controlling interest in C was measured at fair value at the date of acquisition. The fair value of one equity share in C was $1.60 on 1 January 20X4.

3. AZ conducted its annual impairment review and concluded that the goodwill on the acquisition of B was impaired by 20 per cent at 31 December 20X5. No other impairments of goodwill have arisen.

4. The balance on ‘other reserves’ for both AZ and B relate to movements in the values of their investments in B and C respectively.

Required:

(a) Explain how the investments in B and C are accounted for in:

(i) the individual financial statements of AZ and B

(ii) the consolidated financial statements of the AZ Group.

(b) Prepare the consolidated statement of financial position for the AZ Group as at 31 December 20X5.

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn