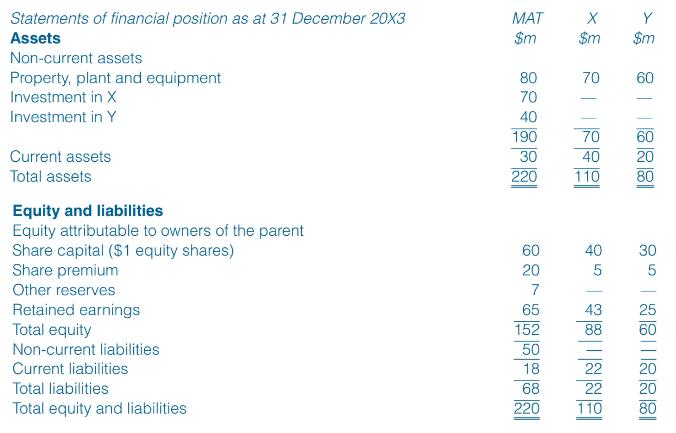

Extracts from the financial statements of MAT, X and Y are presented below. Additional information: 1. MAT

Question:

Extracts from the financial statements of MAT, X and Y are presented below.

Additional information:

1. MAT acquired 80 per cent of the equity share capital of X on 1 January 20X1 when the retained earnings of X were $25 million. This acquisition resulted in MAT having power over X which, when exercised, affects its return from the investment. X has not issued any shares since the acquisition date. The non-controlling interest in X was measured at its fair value of $20 million at the date of acquisition.

2 MAT acquired 50 per cent of the equity share capital of Y on 1 January 20X2 when the retained earnings of Y were $11 million. This acquisition was classified as a joint venture in accordance with IFRS 11 Joint Arrangements. Y has not issued any shares since the acquisition date.

3. MAT conducted its annual impairment review and concluded that the goodwill on the acquisition of X was impaired by 20 per cent at 31 December 20X3. No other impairments of goodwill have arisen.

4. The balance on ‘other reserves’ relates to movements in the values of investments in X and Y in the books of MAT. $5 million relates to X and the remainder to Y.

5. MAT’s non-current liabilities represent a long-term borrowing taken out on 1 January 20X3. The borrowing has a coupon rate of 4 per cent per annum and the interest due in respect of 20X3 has been paid and charged to profit for the year. The effective interest rate associated with this instrument is 8 per cent per annum.

6. For the first time in November 20X3, MAT sold goods to Y with a value of $20 million and a gross margin of 40 per cent. At 31 December 20X3, 75 per cent of these items remained in Y’s inventories.

Required:

(a) Prepare the consolidated statement of financial position for the MAT group as at 31 December 20X3.

(b) MAT acquired a further 4 million of the equity shares of X on 1 January 20X4 for $14 million.

(i) Explain how this additional acquisition will impact on the preparation of the consolidated financial statements of MAT for the year to 31 December 20X4.

(ii) Calculate the adjustment that will be required to be made to the group’s statement of financial position in respect of this acquisition.

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn