Joey, a public limited company, operates in the media sector. Joey has investments in two companies. The

Question:

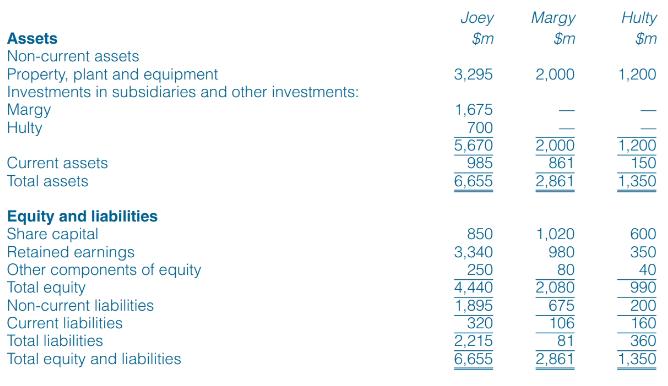

Joey, a public limited company, operates in the media sector. Joey has investments in two companies. The draft statements of financial position at 30 November 20X4 are as follows:

The following information is relevant to the preparation of the group financial statements:

1. On 1 December 20X1, Joey acquired 30 per cent of the ordinary shares of Margy for a cash consideration of $600 million when the fair value of Margy’s identifiable net assets was $1,840 million. Joey treated Margy as an associate and has equity accounted for Margy up to 1 December 20X3. Joey’s share of Margy’s undistributed profit amounted to $90 million and its share of a revaluation gain amounted to $10 million. On 1 December 20X3, Joey acquired a further 40 per cent of the ordinary shares of Margy for a cash consideration of $975 million and gained control of the company. The cash consideration has been added to the equity accounted balance for Margy at 1 December 20X3 to give the carrying amount at 30 November 20X4. At 1 December 20X3, the fair value of Margy’s identifiable net assets was $2,250 million. At 1 December 20X3, the fair value of the equity interest in Margy held by Joey before the business combination was $705 million and the fair value of the non-controlling interest of 30 per cent was assessed as $620 million. The retained earnings and other components of equity of Margy at 1 December 20X3 were $900 million and $70 million respectively. It is group policy to measure the non-controlling interest at fair value.

2 At the time of the business combination with Margy, Joey has included in the fair value of Margy’s identifiable net assets, an unrecognized contingent liability of $6 million in respect of a warranty claim in progress against Margy. In March 20X4, there was a revision of the estimate of the liability to $5 million. The amount has met the criteria to be recognized as a provision in current liabilities in the financial statements of Margy and the revision of the estimate is deemed to be a measurement period adjustment.

3. Additionally, buildings with a carrying amount of $200 million had been included in the fair valuation of Margy at 1 December 20X3. The buildings have a remaining useful life of 20 years at 1 December 20X3. However, Joey had commissioned an independent valuation of the buildings of Margy, which was not complete at 1 December 20X3 and therefore not considered in the fair value of the identifiable net assets at the acquisition date. The valuations were received on 1 April 20X4 and resulted in a decrease of $40 million in the fair value of property, plant and equipment at the date of acquisition. This decrease does not affect the fair value of the non-controlling interest at acquisition and has not been entered into the financial statements of Margy. Buildings are depreciated on the straight line basis and it is group policy to leave revaluation gains on disposal in equity. The excess of the fair value of the net assets over their carrying value, at 1 December 20X3, is due to an increase in the value of non-depreciable land and the contingent liability.

4. On 1 December 20X3, Joey acquired 80 per cent of the equity interests of Hulty, a private entity, in exchange for cash of $700 million. Because the former owners of Hulty needed to dispose of the investment quickly, they did not have sufficient time to market the investment to many potential buyers. The fair value of the identifiable net assets was $960 million. Joey determined that the fair value of the 20 per cent non-controlling interest in Hulty at that date was $250 million. Joey reviewed the procedures used to identify and measure the assets acquired and liabilities assumed and to measure the fair value of both the non-controlling interest and the consideration transferred. After that review, Hulty determined that the procedures and resulting measures were appropriate. The retained earnings and other components of equity of Hulty at 1 December 20X3 were $300 million and $40 million respectively. The excess in fair value is due to an unrecognized franchise right, which Joey had granted to Hulty on 1 December 20X2 for five years. At the time of the acquisition, the franchise right could be sold for its market price. It is group policy to measure the non-controlling interest at fair value. All goodwill arising on acquisitions has been impairment tested with no impairment being required.

5. Joey is looking to expand into publishing and entered into an arrangement with Content Publishing (CP), a public limited company, on 1 December 20X3. CP will provide content for a range of books and online publications. CP is entitled to a royalty calculated as 10 per cent of sales and 30 per cent of gross profit of the publications. Joey has sole responsibility for all printing, binding and platform maintenance of the website. The agreement states that key strategic sales and marketing decisions must be agreed jointly. Joey selects the content to be covered in the publications, but CP has the right of veto over this content. However, on 1 June 20X4, Joey and CP decided to set up a legal entity, JCP, with equal shares and voting rights. CP continues to contribute content into JCP but does not receive royalties. Joey continues the printing, binding and platform maintenance. The sales and cost of sales in the period were $5 million and $2 million respectively. The whole of the sale proceeds and the costs of sales were recorded in Joey’s financial statements with no accounting entries being made for JCP or amounts due to CP. Joey currently funds the operations. Assume that the sales and costs accrue evenly throughout the year and that all of the transactions relating to JCP have been in cash.

6. At 30 November 20X3, Joey carried a property in its statement of financial position at its revalued amount of $14 million in accordance with IAS 16 Property, Plant and Equipment. Depreciation is charged at $300,000 per year on the straight line basis. In March 20X4, the management decided to sell the property and it was advertised for sale. By 31 March 20X4, the sale was considered to be highly probable and the criteria for IFRS 5 Non-current Assets Held for Sale and Discontinued Operations were met at this date. At that date, the asset’s fair value was $15.4 million and its value in use was $15.8 million. Costs to sell the asset were estimated at $300,000. On 30 November 20X4, the property was sold for $15.6 million. The transactions regarding the property are deemed to be material and no entries have been made in the financial statements regarding this property since 30 November 20X3 as the cash receipts from the sale were not received until December 20X4.

Required:

Prepare the group consolidated statement of financial position of Joey as at 30 November 20X4.

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn