On 1 October 20X5, Zanda Co acquired 60 per cent of Medda Cos equity shares by means

Question:

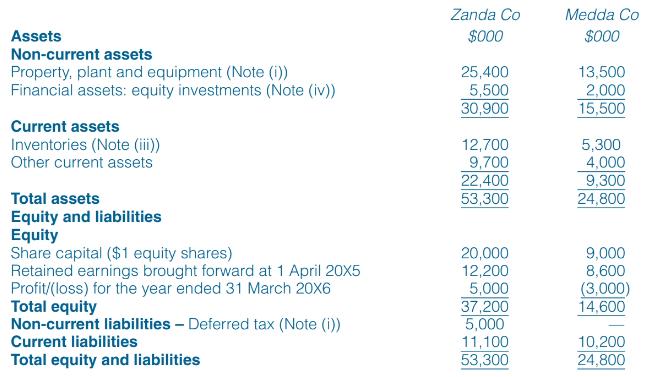

On 1 October 20X5, Zanda Co acquired 60 per cent of Medda Co’s equity shares by means of a share exchange of one new share in Zanda Co for every two acquired shares in Medda Co. In addition, Zanda Co will pay a further $0.54 per acquired share on 30 September 20X6. Zanda Co has not recorded any of the purchase consideration and its cost of capital is 8 per cent per annum. The market value of Zanda Co’s shares at 1 October 20X5 was $3.00 each. The summarized statements of financial position of the two companies as at 31 March 20X6 are:

Additional information:

(i) At the date of acquisition, Zanda Co conducted a fair value exercise on Medda Co’s net assets which were equal to their carrying amounts (including Medda Co’s financial asset equity investments) with the exception of an item of plant which had a fair value of $2.5 million below its carrying amount. The plant had a remaining useful life of 30 months at 1 October 20X5. The directors of Zanda Co are of the opinion that an unrecorded deferred tax asset of $1.2 million at 1 October 20X5, relating to Medda Co’s losses, can be relieved in the near future as a result of the acquisition. At 31 March 20X6, the directors’ opinion has not changed, neither has the value of the deferred tax asset.

(ii) Zanda Co’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, a share price for Medda Co of $1.50 each is representative of the fair value of the shares held by the non-controlling interest.

(iii) At 31 March 20X6, Medda Co held goods in inventory which had been supplied by Zanda Co at a mark-up on cost of 35 per cent. These goods had cost Medda Co $2.43 million.

(iv) The financial asset equity investments of Zanda Co and Medda Co are carried at their fair values at 1 April 20X5. At 31 March 20X6, these had fair values of $6.1 million and $1.8 million respectively, with the change in Medda Co’s investments all occurring since the acquisition on 1 October 20X5.

(v) There is no impairment to goodwill at 31 March 20X6.

Required:

Prepare the following extracts from the consolidated statement of financial position of Zanda Co as at 31 March 20X6:

(i) Goodwill

(ii) Retained earnings

(iii) Non-controlling interest.

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn