Pams Creations had the following sales and purchase transactions during Year 2. Beginning inventory consisted of 60

Question:

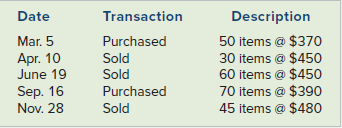

Pam’s Creations had the following sales and purchase transactions during Year 2. Beginning inventory consisted of 60 items at $350 each. The company uses the FIFO cost flow assumption and keeps perpetual inventory records.

Required

a. Record the inventory transactions in a financial statements model.

b. Calculate the gross margin Pam’s Creations would report on the Year 2 income statement.

c. Determine the ending inventory balance Pam’s Creations would report on the December 31, Year 2, balance sheet.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Question Posted: