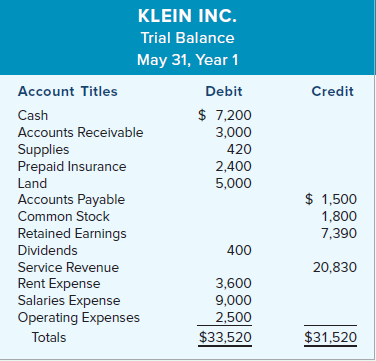

The following trial balance was prepared from the ledger accounts of Klein Inc. The accountant for Klein

Question:

The following trial balance was prepared from the ledger accounts of Klein Inc.

The accountant for Klein Inc. made the following errors during May, Year 1:

1. The cash purchase of land for $3,000 was recorded as a $5,000 debit to Land and a $3,000 credit to Cash.

2. A $1,600 purchase of supplies on account was properly recorded as a debit to the Supplies account but was incorrectly recorded as a credit to the Cash account.

3. The company provided services valued at $7,800 to a customer on account. The accountant recorded the transaction in the proper accounts but in the incorrect amount of $8,700.

4. A $1,200 cash receipt from a customer on an account receivable was not recorded.

5. An $800 cash payment of an account payable was not recorded.

6. The May utility bill, which amounted to $1,050 on account, was not recorded.

Required

a. Identify the errors that would cause a difference in the total amounts of debits and credits that would appear in a trial balance. Indicate whether the Debit or Credit column would be larger as a result of the error.

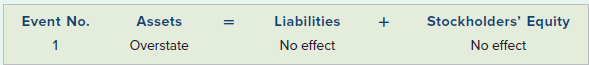

b. Indicate whether each of the preceding errors would overstate, understate, or have no effect on the amount of total assets, liabilities, and equity. Your answer should take the following form:

c. Prepare a corrected trial balance.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds