Tri-Cities Equipment Rentals, LLC rents equipment such as cranes and bulldozers to construction companies, while Sams Tax

Question:

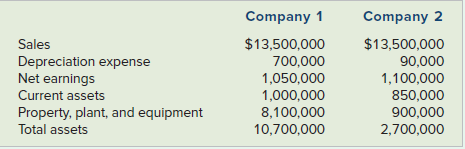

Tri-Cities Equipment Rentals, LLC rents equipment such as cranes and bulldozers to construction companies, while Sam’s Tax Services, LLC provides income tax and accounting services to individuals and small businesses. Sam’s has offices in several cities throughout the mid-Atlantic states. The data that follow are from the companies’ most recent financial statements, but are not identified as to which company they relate.

Required

a. Calculate the ratio of sales to property, plant, and equipment for each company.

b. Based on the ratios calculated in Requirement a, decide which is the equipment rental company and which is the tax and accounting business. Explain your answer.

c. Based on the ratios calculated in Requirement a, which company appears to be using its property, plant, and equipment more efficiently? Explain your answer.

d. Explain why two companies with such different amounts of property, plant, and equipment might have the same amount of current assets.

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds