Assume that a division of Sony Inc. makes an electronic component for its speakers. Its manufacturing process

Question:

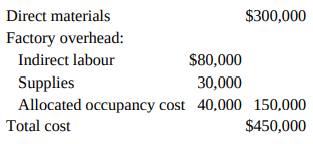

Assume that a division of Sony Inc. makes an electronic component for its speakers. Its manufacturing process for the component is a highly automated part of a just-intime production system. All labour is considered to be an overhead cost, and all overhead is regarded as fixed with respect to output volume. Production costs for 100,000 units of the component are

A small local company has offered to supply the components at a price of $3.45 each. If the division discontinued its production of the component, it would save two-thirds of the supplies cost and $30,000 of indirect labour cost. All other overhead costs would continue. The division manager recently attended a seminar on cost behaviour and learned about fixed and variable costs. He wants to continue to make the component because the variable cost of $3.00 is below the $3.45 bid.

1. Compute the relevant costs of (a) making and (b) purchasing the component. Which alternative is less costly and by how much?

2. What qualitative factors might influence the decision about whether to make or buy the component?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu