Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have

Question:

Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE believes that the problem might be in how the accounting system allocates costs to products.

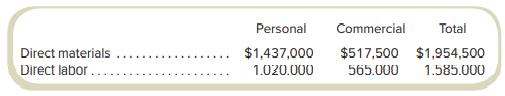

The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which is representative, manufacturing overhead totaled $1,902,000 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows:

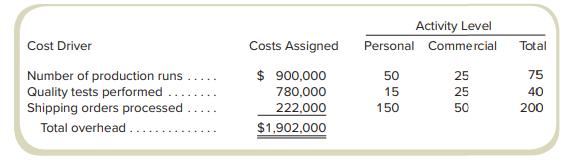

Management has determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year are as follows:

Required

a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product?

b. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product?

c. How might the results from using activity-based costing in requirement (a) help management understand ACE’s declining profits?

Step by Step Answer: