Barker Products is a job shop. The following events occurred in September: 1. Purchased $13,000 of materials.

Question:

Barker Products is a job shop. The following events occurred in September:

1. Purchased $13,000 of materials.

2. Issued $14,500 in direct materials to the production department.

3. Purchased $11,000 of materials.

4. Issued $900 of supplies from the materials inventory.

5. Paid for the materials purchased in transaction (1).

6. Paid $19,200 cash for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant.

7. Incurred direct labor costs of $22,000, which were credited to Wages Payable.

8. Issued $1,300 of supplies from the materials inventory.

9. Applied overhead on the basis of 85 percent of $22,000 direct labor costs.

10. Recognized depreciation on manufacturing property, plant, and equipment of $11,600.

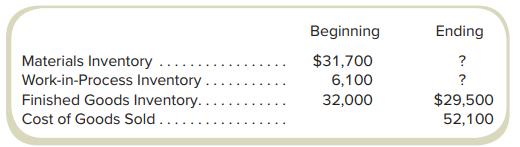

The following balances appeared in the accounts of Barker Products for September:

Required

a. Prepare journal entries to record the transactions.

b. Prepare T-accounts to show the flow of costs during the period from Materials Inventory through Cost of Goods Sold.

Step by Step Answer: