Commonwealth Devices makes three wearable fitness devices at its Lake Plant: CFit-1, CFit-2, and CFit-Xtra. The company

Question:

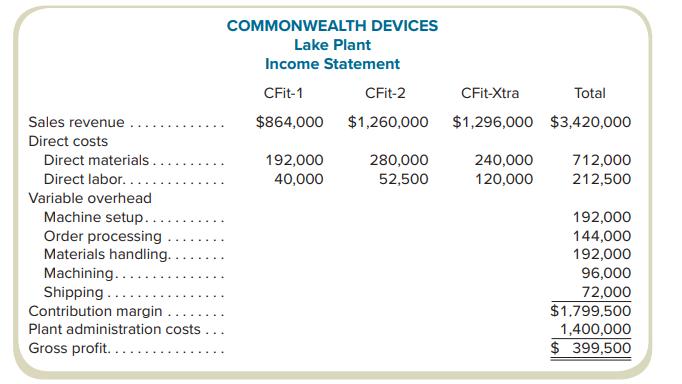

Commonwealth Devices makes three wearable fitness devices at its Lake Plant: CFit-1, CFit-2, and CFit-Xtra. The company has for many years allocated overhead to products using machine-hours. Last year, the Lake Plant produced and shipped 8,000 units of CFit-1, 14,000 units of CFit-2, and 8,000 units of CFit-Xtra. The plant recorded the following revenues and costs:

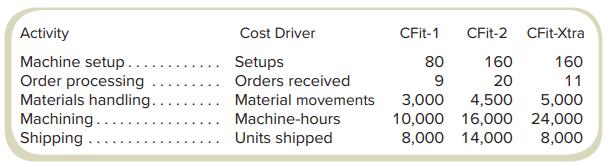

The Lake Plant has put together an employee team to recommend a possible activity-based cost system, including cost allocation bases. The employee team recommends the following:

The employee team further recommends that administration costs not be allocated to products.

Required

a. Using machine-hours to allocate overhead, complete the income statement for the Lake Plant. Do not allocate administrative costs to products.

b. Complete the income statement using the activity-based costing method suggested by the employee team.

c. Write a brief report indicating how activity-based costing might result in better decisions by managers at Commonwealth Devices and the Lake Plant.

d. After hearing the recommendations, the plant manager expresses concern about failing to allocate administrative costs. If plant administrative costs were to be allocated to products, how would you allocate them?

Step by Step Answer: