The following data are available for two divisions of Ryan Enterprises: The cost of capital for the

Question:

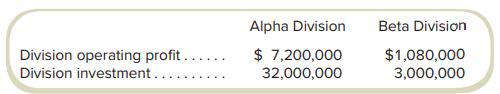

The following data are available for two divisions of Ryan Enterprises:

The cost of capital for the company is 7 percent. Ignore taxes.

Required

a. If Ryan measures performance using ROI, which division had the better performance?

b. If Ryan measures performance using economic value added, which division had the better performance? (The divisions have no current liabilities.)

c. Would your evaluation change if the company’s cost of capital was 10 percent? Why?

Transcribed Image Text:

Division operating profit. Division investment... Alpha Division $ 7,200,000 32,000,000 Beta Division $1,080,000 3,000,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (10 reviews)

a b Using EVA c Using ROI the comparison is not affected by the cost of ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following data are available for two divisions of Solomons Company: The cost of capital for the company is 10 percent. Ignore taxes. Required a. If Solomons measures performance using ROI, which...

-

The following data are available for two divisions of Solomons Company. The cost of capital for the company is 8 percent. Ignore taxes. Required a. If Solomons measures performance using ROI, which...

-

The following data are available for two companies, Apple and Oracle, all stated in thousands of dollars. (a) Calculate each companys return on equity (ROE) and return on assets (ROA). (b) Which...

-

Consider the rigid aircraft in planar flight indicated below with points P and R separated by distance L. Known measurement data includes components of translational velocity and acceleration vectors...

-

Describe the six types of problem members in meetings. How does each cause a problem to the group?

-

Using the Microsoft Drivers for PHP for SQL Server as an example, briefly describe how to install and enable additional PHP dynamic extension *.dll files to an existing PHP installation.

-

In 1940, the family of Thomas Back entered into an oil-and-gas lease with the Inland Gas Corporation. The lease held that Inland would pay to Backs family 12 cents per thousand cubic feet of gas...

-

A project was planned using PERT with three time estimates. The expected completion time of the project was determined to be 40 weeks. The variance of the critical path is 9. (a) What is the...

-

In the estimation of international trade's casual effect on country's income, InYa+BT+yWi+i, = where Y; denotes income per person, T; denotes international trade, W; denotes within-country trade and...

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Employee Number Name and Address Payroll information...

-

If a divisions residual income falls from one period to the next, does that mean that the divisions performance is declining? Why?

-

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business...

-

Matrix multiplication plays an important role in a number of applications. Two matrices can only be multiplied if the number of columns of the first matrix is equal to the number of rows in the...

-

Ralph makes ( 21)/(2) batches of oatmeal cookies. Each batch makes 24 cookies. Ralph gives away ( 1)/(4) of his cookies to his class at school and ( 2)/(5) of his remaining cookies to his bus driver....

-

Nadine is the vice president of a Canadian-Controlled Private Corporation (CCPC) and owns 25% of its shares. Her husband, Theo, is an employee of the CCPC. Nadine and Theo each have life insurance....

-

6. (a) Implement the basic radiosity algorithm for rendering the inside surfaces of a cube when one inside face of the cube is a light source. (b) Write a program (using any common high-level...

-

Discuss how an information system's architecture planning contributes to overall enterprise risk in the organizations. Research & share the reference(s) for the following elements for a specific...

-

Always Stayed Focus The new Audi A3. Discuss the following question? How does the advertisement attempt to get your attention? What is it an advertisement for? Who is the target audience for this...

-

When Payne removed his bank statement from the envelope, it got caught on a staple and a corner was ripped from the page. Now he cannot read his ending balance. Explain the computations he can do to...

-

As you rewrite these sentences, replace the cliches and buzzwords with plain language (if you don't recognize any of these terms, you can find definitions online): a. Being a jack-of-all-trades, Dave...

-

Refer to the example in Appendix B. The numbers in Exhibit 5.21 for the fifth, sixth, and seventh units were given. Required Using the formula Y = aXb and the data given in the problem, verify the...

-

The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow: In addition to the above information,...

-

The accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow: In addition to the above information,...

-

Where and how have teamwork skills been taught or emphasized to you? in school? in social groups? in professional groups? in your family? Describe two or three instances where teamwork skills were...

-

Students often say that groups in school are different from groups in the workplace, giving this as a reason for not using groups in school. Is it a valid excuse? Summarize the major differences...

-

Drawing on Albrecht, explain how social capital and natural disaster are connected. Drawing on Islam, how is sociological theory helpful for understanding environmental issues? Describe some ways...

Study smarter with the SolutionInn App