West State Furniture (WSF) manufactures desks and desk chairs using two departments within a single facility. The

Question:

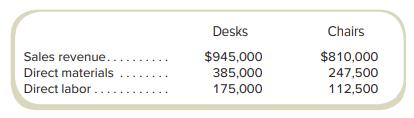

West State Furniture (WSF) manufactures desks and desk chairs using two departments within a single facility. The West Department produces the desks, and the State Department produces the chairs. WSF uses plantwide allocation to allocate its overhead to all products. Direct materials cost is the allocation base. The rate used is 60 percent of direct materials cost. Last year, revenue, direct materials, and direct labor were as follows.

Required

a. Compute the profit for each product using plantwide allocation.

b. The new CFO at WSF was surprised that the company used a plantwide rate because the two products were produced in separate departments. The cost analyst estimated the overhead rates for each department separately. Using department rates, the West Department rate would be 33 percent of direct materials cost. The State Department rate would be 102 percent of direct materials cost. Recompute the profits for each product using each department’s allocation rate (based on direct materials cost in each department).

c. Which overhead allocation method, plantwide or department, allocates more total overhead to the two products? Explain.

Step by Step Answer: