Langdale Ltd is a small company manufacturing and selling two different products the Lang and the

Question:

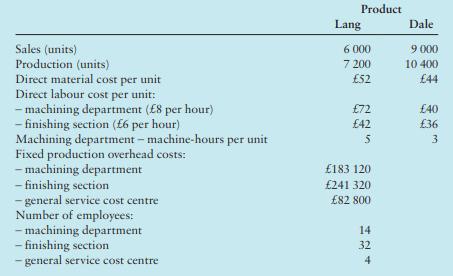

Langdale Ltd is a small company manufacturing and selling two different products – the Lang and the Dale. Each product passes through two separate production cost centres – a machining department, where all the work is carried out on the same general purpose machinery, and a finishing section. There is a general service cost centre providing facilities for all employees in the factory. The company operates an absorption costing system using budgeted overhead absorption rates. The management accountant has calculated the machine hour absorption rate for the machining department as £3.10 but a direct labour hour absorption rate for the finishing section has yet to be calculated. The following data have been extracted from the budget for the coming year:

Service cost centre costs are reapportioned to production cost centres.

Required

1. Calculate the direct labour hour absorption rate for the finishing section.

2. Calculate the budgeted total cost for one unit of product Dale only, showing each main cost element separately.

3. The company is considering a changeover to marginal costing. State, with reasons, whether the total profit for the coming year calculated using marginal costing would be higher or lower than the profit calculated using absorption costing. No calculations are required.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan