Wolfgang Iser, the accountant of Starkuchen, wants to further examine the relative profitability of raisin cake and

Question:

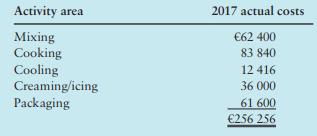

Wolfgang Iser, the accountant of Starkuchen, wants to further examine the relative profitability of raisin cake and layered carrot cake. He questions the accuracy of the activity-based normal costing numbers. He notes that the 2017 actual manufacturing indirect cost was €256,256. This differs sizably from the €210,800 budgeted amount. The 2017 actual indirect costs per activity area were as follows:

Required

1. Calculate the under- or overallocated manufacturing indirect costs in 2017 for: a Each of the five activity area indirect-cost pools. b The aggregate of individual activity area indirect costs.

2. Assume that Starkuchen allocates under- or overallocated indirect costs to individual accounts based on the allocated overhead component in that account. What are the pros and cons of using:

a. Five separate under- or overallocated adjustments (one for each activity area)?

b. One under- or overallocated adjustment for the aggregate of all activity area indirect costs?

3. Calculate the 2017 actual unit product cost for raisin cake and layered carrot cake using the information calculated in requirement 1a.

4. Comment on the implications of the product-cost numbers in requirement 3 for Starkuchen’s pricing decisions in 2018.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan