Beach Foods (Beach) is a family-owned business which has grown strongly over its 100-year history. The objective

Question:

Beach Foods (Beach) is a family-owned business which has grown strongly over its 100-year history. The objective of the business is to maximize the family?s wealth through their shareholdings. Beach has three divisions. It manufactures a variety of foods in two of the divisions: Beach Baby Foods (Baby) and Beach Chocolate Foods (Chocolate). Each of these divisions knows its own market and sets prices accordingly. The third division (R&D) researches new products on the instructions of the other divisions and is considered to be vital to the survival and growth of Beach.The board of Beach has been considering the impact of using a divisional structure and has come to you as a performance management consultant to ask for your advice.There is disagreement at board level about the correct choice of divisional performance measure to be used in the two manufacturing divisions. Currently, the business uses EVA? but two directors have been questioning its value, complaining that it is complicated to understand. These directors have been promoting the use of either residual income (RI) or return on investment (ROI) as alternatives. The board wants to use the same measure for each division. As well as qualitatively evaluating these different measures, the board needs an assessment of the impact of a change in performance measure on their perception of these divisions? performance. Therefore, as an example, they require you to calculate and discuss the use of ROI and RI at Baby division, given the data in Appendix 1.The chief executive officer (CEO) of Beach has engaged a business analyst to perform a study of the portfolio of manufacturing businesses which make up Beach. This has been completed in Appendix 2. The CEO wants your comments (based on the categorization given in Appendix 2) on how this work will impact on the performance management of the divisions.Specifically, the CEO has asked for your recommendations on how to control each division; that is, whether each division should be treated as a cost/profit/investment centre and also, the appropriate management style to use for handling staff in each division. The CEO commented to you:?I have heard of different approaches to the use of budget information in assessing performance: budget-constrained, profit-conscious and also a non-accounting style. I need to know how these approaches might apply to each division given your other comments.?All of this work has been partly prompted by complaints from the divisional managers. The Chocolate divisional managers complain that they had to wait for a year to get approval to upgrade their main production line. This production line upgrade has reduced wastage and boosted Chocolate?s profit margin by 10 percentage points. The Baby division has been very successful in using the ideas of the R&D division, although Baby?s managers do complain about the recharging of R&D costs to their division.Head office managers are worried about Chocolate as it has seemed to be drifting recently with a lack of strategic direction. Chocolate?s managers are considered to be good but possibly not sufficiently focused on what benefits Beach as a whole.

Required:(a) Assess the use of EVA? as a divisional performance measure for the manufacturing divisions at Beach.(b) Using Appendix 1, calculate the ROI and RI for Baby and assess the impact of the assumptions made when calculating these metrics on the evaluation of the performance of this division and its management.(c) Provide justified recommendations for each division?s control and management style as requested by the CEO.

Appendix 1Figures from Beach management accounts for year ended 31 March:

Bab division....................................................................................$mRevenue ...................................................................220CostsDivisional operating costs ......................................121R&D costs recharged ................................................11Allocated head office management fees ...............28Profit before tax ........................................................60Capital employed ....................................................424

1. Baby launched a new product with a large publicity campaign during the year.2. The notional cost of capital for Baby is estimated by the chief financial officer at 11 percent. WACC for Beach is 7.5 percent.3. ROI for similar entities is 20 percent.4. EVA? for Baby is calculated as $35m.

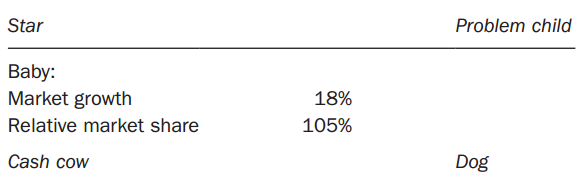

Appendix 2

Chocolate:Market growth ...................3%Relative market share ...120%

Relative market share is the market share of the division compared to that of the market leader. If an organization is a market leader, then its market share is compared to the next largest competitor.You may assume that the calculations and this categorization are accurate.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: