HB makes and sells a single product. The company operates a standard marginal costing system and a

Question:

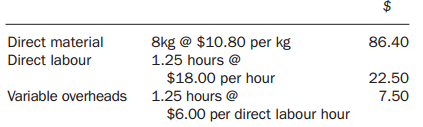

HB makes and sells a single product. The company operates a standard marginal costing system and a just-in-time purchasing and production system. No inventory of raw materials or finished goods is held.Details of the budget and actual data for the previous period are given below:Budget dataStandard production costs per unit:

Standard selling price: $180 per unitBudgeted fixed production overheads: $170 000Budgeted production and sales: 10 000 unitsActual dataDirect material: 74 000 kg @ $11.20 per kgDirect labour: 10 800 hours @ $19.00 per hourVariable overheads: $70 000Actual selling price: $184 per unitActual fixed production overheads: $168 000Actual production and sales: 9000 units

Required:

(a) Prepare a statement using marginal costing principles that reconciles the budgeted profit and the actual profit. Your statement should show the variances in as much detail as possible.

(b) (i) Explain why the variances used to reconcile profit in a standard marginal casting system are different from those used in a standard absorption costing system.

(ii) Calculate the variances that would be different and any additional variances that would be required if the reconciliation statement was prepared using standard absorption costing. Preparation of a revised statement is not required.

(c) Explain the arguments for the use of traditional absorption costing rather than marginal costing for profit reporting and inventory valuation.

Step by Step Answer: