Iron Chicken (IC) is a multinational business which manufactures commercial building control systems. Building control systems include

Question:

Iron Chicken (IC) is a multinational business which manufactures commercial building control systems. Building control systems include heating and air-conditioning systems, lighting controls, power and water monitoring and security systems (e.g. keypad access, alarms and CCTV). IC?s manufacturing takes place at a number of factory sites where some products have a long product life and are simple and mass-produced while other products are complex and have a short product life due to changing technologies. IC?s mission statement is ?to create value for shareholders through control products which improve productivity, save energy and increase comfort and safety?.A new chief executive officer (CEO) has been appointed to address a decline in IC?s share price in the last three years. This CEO has identified that the business has grown through acquisition and as a result she stated, ?Senior management have focused on making corporate deals and not making control systems.? The CEO has declared that the business must focus on optimizing its value generation rather than just getting larger through acquisitions.You are a performance management expert within IC.The CEO has tasked you with aiding her in aspects of her improvement programme. First, she wants your views on the use of EVA? as the key performance metric at IC. You have been supplied with the current EVA? calculation (Appendix 1) but there is some doubt about whether the junior management accountant who has done this work was sufficiently trained in the method. So, the CEO needs you to evaluate its accuracy and the assumptions which form part of the calculation.Second, the CEO believes that the poor performance of the company can be addressed by ensuring that the mission statement flows down into the performance management of the business. To that end, the following critical success factors (CSFs) have been identified and the CEO wants you to suggest additional key performance indicators (KPIs) for these.

CSF .......................................................Associated current KPI1 Greater staff productivity ...................Units produced per labour hour2 Reduction of wastage in production ..Power consumed per unit produced3 Greater innovation of products ..........Number of new products launched

Third, in order to improve performance, the CEO plans to implement initiatives associated with ?lean? manufacturing.Specifically, there are three projects which have been suggested and the CEO needs your advice on these:1. Move to just-in-time manufacturing2. Use kaizen costing3. Examine the costs of quality in achieving a ?zero defects? approach to manufacturingThe CEO has stated, ?I need to know briefly how the improvement projects will meet the three CSFs and also how they will impact on the existing three KPIs.?Finally, the CEO requested, ?You must tell me the implications of the improvement projects for our information systems as I feel that they are not currently suitable for the plan that I have.? The current information systems of the company are based around the functional departments of the business such as manufacturing, marketing, finance and logistics.Each department has developed its own system although all feed into the finance system which is the main one used for strategic decision-making. In order that the department systems can all feed through to the current finance system, these current systems only handle quantitative data. The company is considering the implementation of a new information system.This new system will introduce networking technology in order to bring together all of the departmental systems into a new, single, corporate database.

Required:Write a report to the CEO of Iron Chicken to:(i) Evaluate the accuracy of the EVA? calculation and the assumptions in Appendix 1. Advise the CEO on your results, providing calculations as needed.(ii) For each of the three critical success factors at IC, briefly explain a weakness of the current KPI associated with that CSF and then provide a justified alternative KPI.(iii) Explain what the three improvement projects are, how they will help to meet the CSFs at IC and comment on the impact of each project on the existing three KPIs.(iv) Assess the impact of the proposed, new information system on the three improvement projects. Professional marks will be awarded for the format, style and structure of the discussion of your answer.

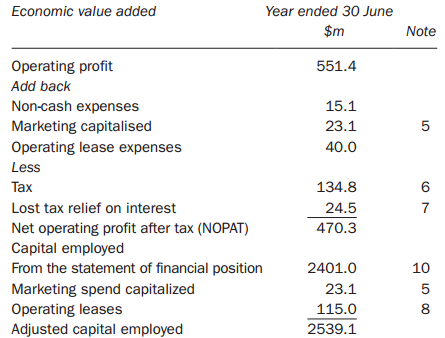

Appendix 1

WACC = (1/2 ? 16%) + (1/2 ? 6.8%) = 11.4%

EVATM = NOPAT ? (WACC ? Capital employed) = 181

Assumptions and notes:1. Debt/Equity ............................100.0%2. Cost of equity ...........................16.0%3. Tax Rate ..................................30.0%4. Cost of debt (pre-tax) ................6.8%5. There has been $23.1m of marketing spent each year for the last two years in order to build the brand of IC long term.6. Tax paid in the year was $130m while the tax charged per the accounts was $134.8m.7. Interest charged in the period was $81.6m. Lost tax relief on this interest was 30% 3 $81.6m.8. The operating leases have an average life of four years.9. The only research and development spending identified in the last five years was $10m expensed during this year on a new product.The product has not been launched yet.10. Capital employed during the period (from the statement of financial position):Opening .......................2282.0Change in period ...........119.0Closing ........................2401.0

Cost Of DebtThe cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking... Cost Of Equity

The cost of equity is the return a company requires to decide if an investment meets capital return requirements. Firms often use it as a capital budgeting threshold for the required rate of return. A firm's cost of equity represents the...

Step by Step Answer: