Landual Lamps (Landual) manufactures and delivers floor and table lamps for homes and offices in Beeland. The

Question:

Landual Lamps (Landual) manufactures and delivers floor and table lamps for homes and offices in Beeland. The company sells through its website and uses commercial logistics firms to deliver their products. The markets for its products are highly competitive. The company has traditionally relied on the high quality of its designs to drive demand for its products.The company is divided into two divisions (components and assembly), plus a head office that provides design, administrative and marketing support. The manufacturing process involves:

1. The components division making the housing components and electrical components for the lamp. This is an intricate process as it depends on the specific design of the lamp and so serves as a significant source of competitive advantage for Landual;2. The assembly division assembling the various components into a finished lamp ready for shipment. This is a simple process.The finance director (FD) of Landual is currently overloaded with work due to changes in financial accounting policies that are being considered at board level. As a result, she has been unable to look at certain management accounting aspects of the business and has asked you to do a review of the transfer pricing policy between the components and assembly divisions.The current transfer pricing policy at Landual is as follows:(a) Market prices for electrical components are used as these are generic components for which there is a competitive external market;(b) Prices for housing components based on total actual production costs to the components division are used as there is no external market for these components since they are specially designed for Landual?s products.

Currently, the components division produces only for the assembly division in order to meet overall demand without the use of external suppliers for housing and electrical components.If the components division were to sell its electrical components externally,then additional costs of $269 000 would arise for transport, marketing and bad debts.The FD is considering two separate changes within Landual: one to the transfer pricing policy and a second one to the divisional structure.First, the transfer pricing policy for housing components would change to use variable cost to the components division.The FD wants to know the impact of the change in transfer pricing policy on the existing results of the two divisions and the company. (No change is proposed to the transfer price of the electrical components.)Second, as can be seen from the divisional performance report below, the two divisions are currently treated as profit centres. The FD is considering splitting the components division into two further separate divisions: an electrical components division and a housing components division. If the board agrees to this proposal, then the housing components division will be treated as a cost centre only, charging its total production cost to the assembly division. The electrical components and assembly divisions will remain as profit centres.

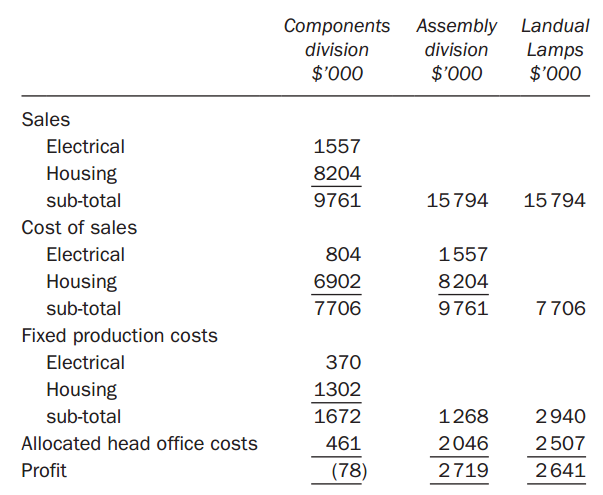

The FD needs to understand the impact of this proposed new divisional structure on divisional performance assessment and on the company as a whole. She has asked that, in order to keep the discussion on the new divisional structure simple, you use the existing transfer pricing policy to do illustrative calculations. She stated that she would reallocate head office costs to the two new components divisions in proportion to their cost of sales.You are provided with the following financial and other information for Landual Lamps.

Actual data for Landual Lamps for the year ended 31 March

1. The components division has had problems meeting budgets recently, with an adverse variance of $575 000 in the last year. This variance arises in relation to the cost of sales for housing component production.

Required:(a) Evaluate the current system of transfer pricing at Landual, using illustrative calculations as appropriate.(b) Advise the finance director (FD) on the impact of changing the transfer pricing policy for housing components as suggested by the FD and comment on your results, using illustrative calculations as appropriate.(c) Evaluate the impact of the change in proposed divisional structure on the profit in the divisions and the company as directed by the FD.

Step by Step Answer: